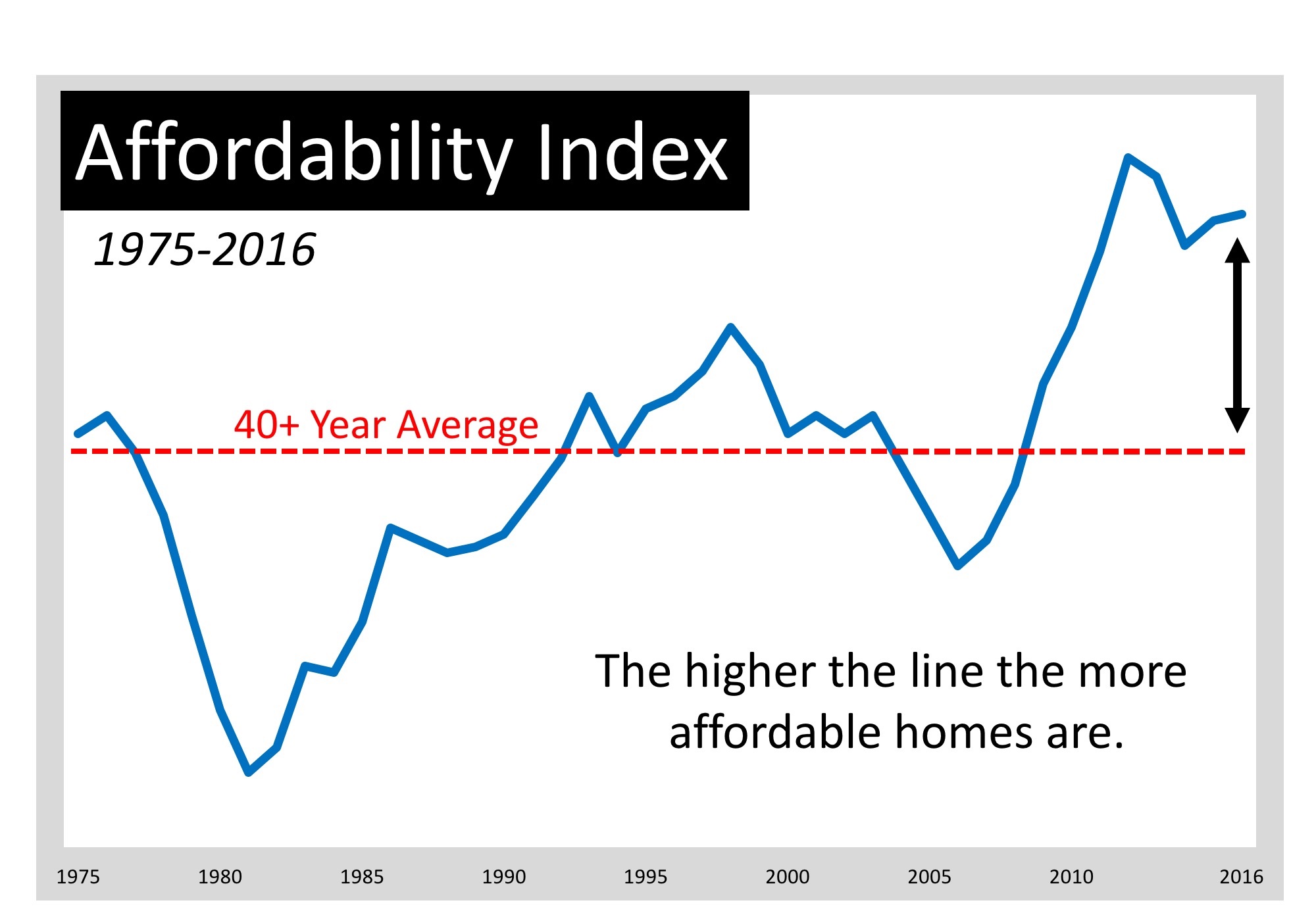

Upsizing? Housing Affordability is Better Now than in the Past 40 Years

If you are thinking of moving up to a larger home or moving to a better area, now is the time to sell.

According to an article called Not Your Father’s Housing Market by Trulia, which is about housing affordability over the last 40 years:

“Nationally, homes are just about the most affordable they’ve been in the last 40 years… the median household could afford a home 1.5 times more expensive than the median home price. In 1980, the median household could only afford about 3/4 of the median home price.

Despite relatively stagnant incomes, affordability has grown due to the sharp drop in mortgage rates over the last 30 years – from a high of over 16% in the 1980s to under 4% by 2016.

Of the nation’s 100 largest metros, only Miami became unaffordable between 1990 and 2016. Meanwhile, 22 metros have flipped from being unaffordable to becoming affordable in that same time frame.”

Except for the housing crash in the past 10 years, the graph shows that homes are more affordable now than in the past 40 years.

Now is the time to sell and purchase a new home if you’re thinking about it. With home prices and mortgage rates rising, affordability will also go down. Time is of the essence.

If you’ve been monitoring the market and have been waiting for the right time, this is it.

Meet with a realtor like Pete Veres, CRS – Certified Residential Specialist & ABR – Accredited Buyers and Seller Representative who can help you navigate thru the process and get the job done for you. He can provide you with a Free Market analysis when you are ready. Pete Veres has had over 25 years of Sales & Marketing experience, excellent negotiating skills and a superb track record.

You can contact him by calling or texting him at 505-362-2005 or by emailing him at [email protected].

He has a great website full of the latest information at www.NMElite.com

Here are also some Free Sellers resources. VIP-Seller-Resources