Sandia Heights Stuff the Truck Event

Displaying blog entries 1-10 of 14

Home prices have gone up recently and the reason behind it is that there are a lot more home buyers than homes that are on the market. You may be thinking that this isn’t a good thing, but it actually is.

What’s good about the increase in prices, according to CoreLogic’s US Economic Outlook, is that the average American home has gained equity over $11,000 over the course of last year. This is a national average. In Albuquerque our market average was 4.13% but the prices are area specific.

People are investing their new-found equity on themselves and on their home which is excellent. Investing it on their home is a lot better than spending it on depreciating assets.

This equity helps people put their kids through school, invest in business and even pay off their mortgages earlier.

It is predicted that home equity will appreciate by 5% next year.

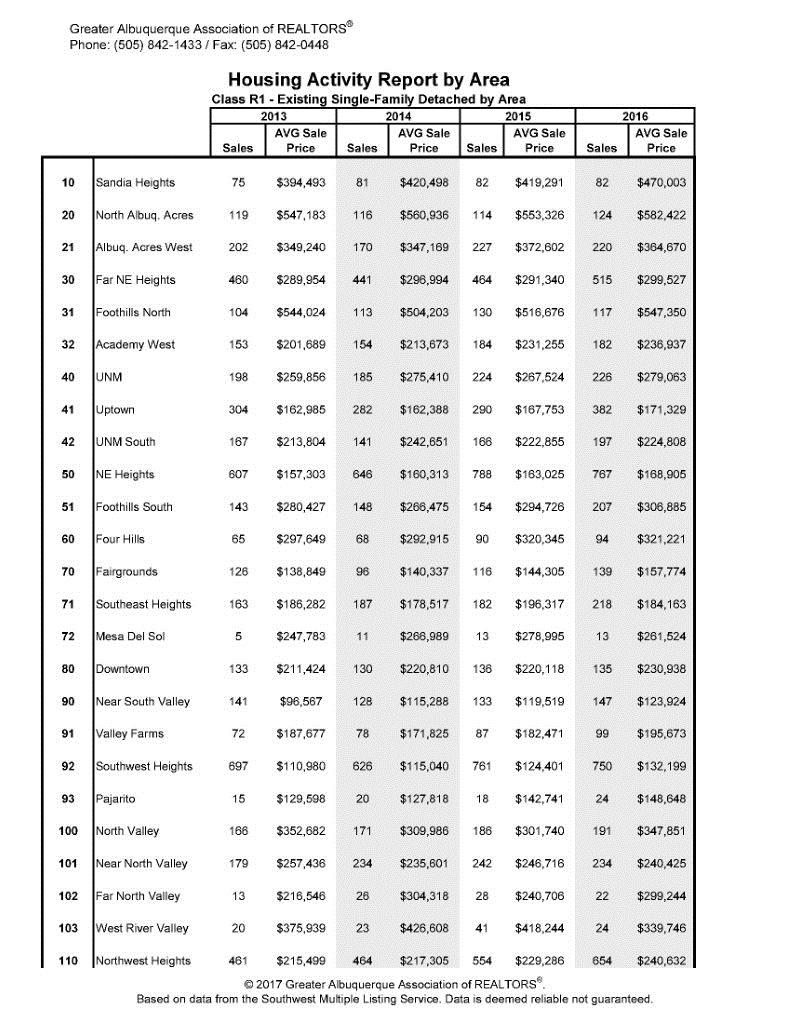

Here are some stats for Albuquerque.

The average annual sales price for single-family detached homes rose 4.13% to $224,230

The median annual sales price for single-family detached homes grew 5.42% to $189,755

The number of attached and detached home sold jumped 7.65% to 11,764 transactions this year

Inventory of the 3,247 existing homes for sale is at its lowest level since May 2006

Here’s the complete Albuquerque 2016 Yearly Real Estate Summary: 2016 Market Report

If you are thinking of selling this may be a great time. First thing is to get a market analyisis to see how homes are priced in your area. Contact Pete Veres at 505-362-2005 for your free market analysis.

Track the Market: Get the latest market updates here: www.abqmarketinfo.com

With the free market snapshot, you’ll get real-time real estate updates sent directly to your email.

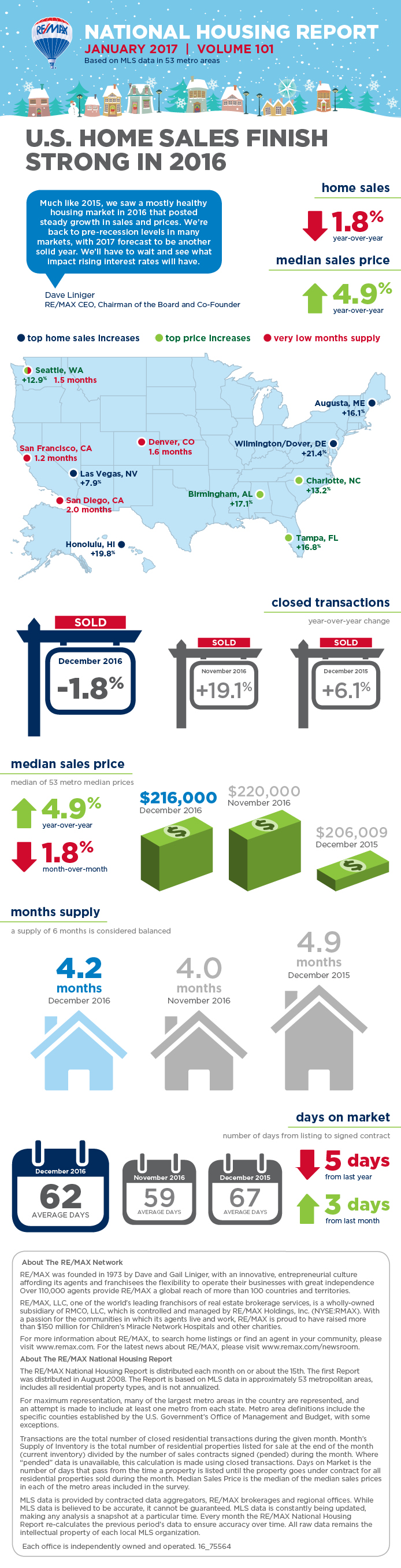

The 2016 Market Statistics are in and we wanted to share those with you. Our market continues to show improvement. We are still seeing some excellent buying opportunities in some areas but inventory is dropping which means the market will start to favor sellers. Here are a few stats and if you would like the complete Albuquerque 2016 Yearly Real Estate Summary please click here: 2016 Market Report. In addition, if you would like to track the Homes for Sale, Homes Pending and Homes Sold in your Area go to www.AbqMarketinfo.com for your Free Market snapshot.

A Few Stats for the 2016 Greater Albuquerque area housing market:

The average annual sales price for single-family detached homes rose 4.13% to $224,230

The median annual sales price for single-family detached homes grew 5.42% to $189,755

The number of attached and detached home sold jumped 7.65% to 11,764 transactions this year

Inventory of the 3,247 existing homes for sale is at its lowest level since May 2006

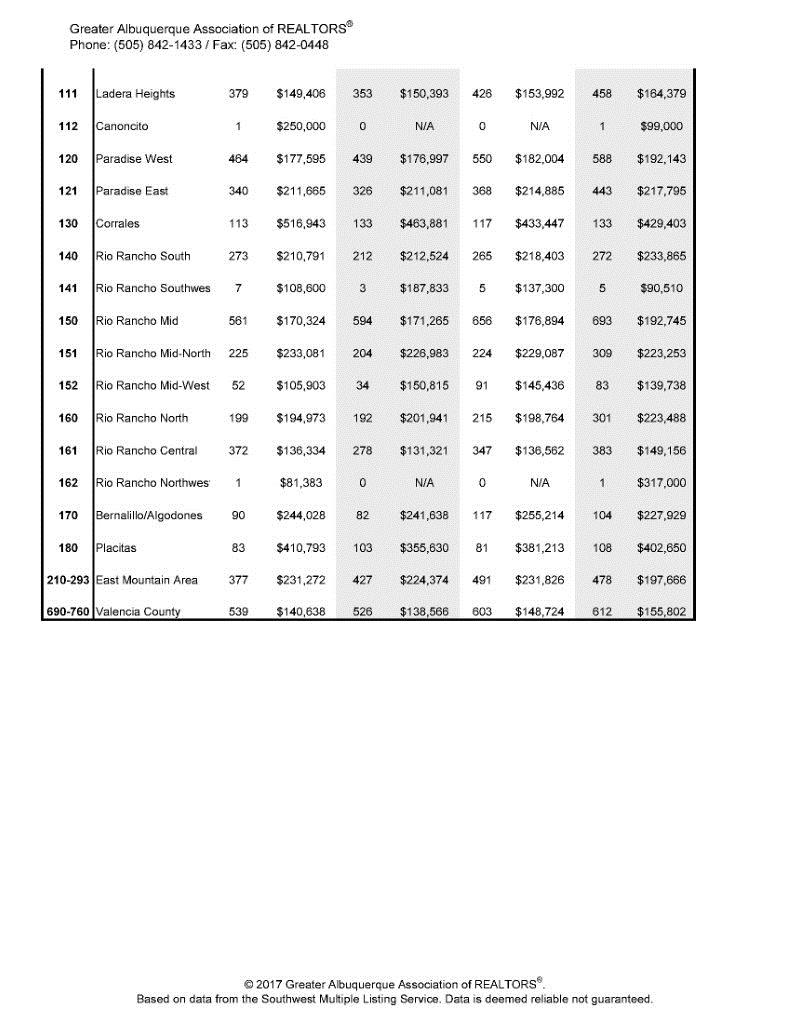

Pete Veres wanted to provide the Sandia Heights 2016 Market Summary. Sandia Heights is seeing improvement and if you would like the track the homes for sale, homes pending and homes sold, get your Free Market Snapshot by going to www.SandiaHomevalues.com If you would like a formal market analysis of your home please contact Pete at 505-362-2005.

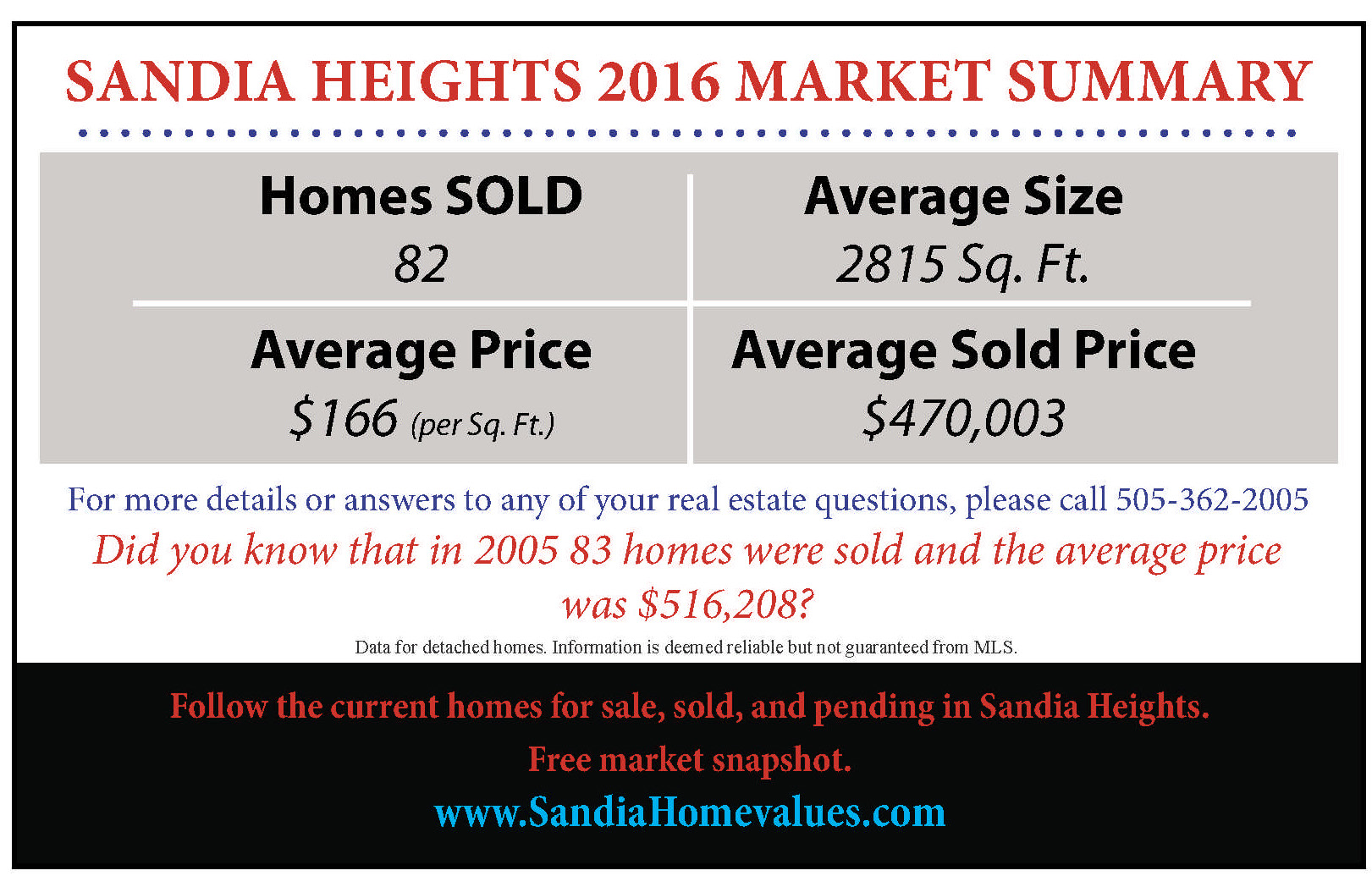

U.S. Home Sales Finish Strong in 2016

DENVER (Jan. 17, 2017) – Capped off by a strong December, 2016 was the best year for U.S. home sales since the recession, according to the January 2017 RE/MAX National Housing Report. Home sales in 2016 were the highest in the housing report’s eight-year history, topping the sales of 2015, the previously strongest year. Nine months of 2016 posted sales greater than in the same months of 2015.

According to the 53-market report, the trend of rising prices and shrinking inventory continued in December, even though December was one of the three months that trailed 2015, with sales 1.8% below December 2015. Even so, nearly half of the markets reported increased sales over December 2015, and almost two-thirds saw sales higher than November 2016. The median increase over November 2016 was 1.7%.

The median sales price of $216,000 was 4.9% above one year ago and only 1.8% below November’s.

Inventory declined 17.9% year-over-year in December, continuing a year-long streak of double-digit declines. Months Supply of Inventory was 4.2, with 47 markets below the 6 months normally considered a balanced market.

The average Days on Market of 62 was the lowest of any December in the report’s history.

“Much like 2015, we saw a mostly healthy housing market in 2016 that posted steady growth in sales and prices,” said Dave Liniger, RE/MAX CEO, Chairman of the Board and Co-Founder. “We’re back to pre-recession levels in many markets, with 2017 forecast to be another solid year. We’ll have to wait and see what impact rising interest rates will have.”

Closed Transactions

Of the 53 metro areas surveyed in December, the overall average number of home sales fell 1.8% compared to December 2015. But nearly half of the 53 metro areas experienced an increase in sales year-over-year, with three experiencing double-digit increases. The markets with the largest increase in sales included Wilmington/Dover, DE +21.4%, Honolulu, HI +19.7%, Augusta, ME +16.1%, Las Vegas, NV +7.9% and Providence, RI +7.3%.

Median Sales Price – Median of 53 metro median prices

In December, the median of all 53 metro Median Sales Prices was $216,000, down 1.8% from November but up 4.9% from December 2015. Of the 53 metro areas surveyed, all but two (Des Moines, IA and New Orleans, LA) saw year-over-year increases or remained unchanged with nine rising by double-digit percentages. The largest double-digit increases were seen in Birmingham, AL +17.1%, Tampa, FL +16.8%, Charlotte, NC +13.2%, Seattle, WA 12.9% and Orlando, FL +12.3%.

Days on Market – Average of 53 metro areas

The average Days on Market for homes sold in December was 62, up three days from the average in November 2016, but down five days from the December 2015 average. The two metro areas with the lowest Days on Market were Omaha, NE and Denver, CO both at 36. The highest Days on Market averages continued to be in Augusta, ME at 141, and Burlington, VT at 101. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 53 metro areas

The number of homes for sale in December was down 14.0% from November, and down 17.9% from December 2015. Based on the rate of home sales in December, the Months Supply of Inventory was 4.2, compared to November at 4.0 and December 2015 at 4.9. A 6.0-month supply indicates a market balanced equally between buyers and sellers. In December, 47 of the 53 metro areas surveyed reported a months supply of less than 6.0, which is typically considered a seller’s market. One reported a balanced market at 6.0, while the remaining five saw a months supply above 6.0, which is typically considered a buyer’s market. The markets with the lowest Months Supply of Inventory continued to be in the West, with San Francisco, CA at 1.2, Seattle, WA at 1.5 and Denver, CO at 1.6.

Buying a Home: What does your Buyers Agent do for you? Part 2.

By: Pete Veres, CRS, CLHMS,SRES,ABR - Accredited Buyers Representative

Lets start this update with a quick video.

So here is a continuation of Part one: What we do for our buyers.

Educate you on market conditions.

18. We will let you know whether it is a buyers’ market or a sellers’ market.

19. I will go through statistics on what percent of list price the sellers are currently receiving.

20. We always show you the trends including, current average days on market, current absorption rate, and/or current months of

inventory.

We will guide you through making an offer and represent you and your

interests in negotiations.

21. I always prepare a CMA so that you make the proper offer.

22. We show you on what comparable properties are selling for.

23. We will explain the common contract contingencies.

24. We will get the appropriate seller disclosures.

25. Discuss the timing of deadlines.

26. We will work togther to put in place a negotiating strategy.

27. We will all local, state and federally required disclosure forms.

28. Complete the purchase agreement.

29. We will educate you on the contents of the sales contract and specifics to our market.

30. We will ensure that all forms are completed properly.

31. We will help you negotiate the best terms and conditions based on our current market conditions.

Quick Easy Way to Preview 4 homes without any pressure.

Tour starts at 2:00pm Sharp! April 28, 2013

Please meet us at 2:00pm and then we will head off to the second home at 2:15. We tour 4 homes and spend about 10 minutes at each. We want to make this quick and easy and if your would like to go back to one of these homes or any others just let us know and we will set up an appointentment thats works best for you.

Sandia Heights Home Tour

Elite Asset Management Team – RE/MAX Elite

Hosted by: Pete Veres 505-362-2005

|

Time |

Address |

Size |

List Price |

|

2:00-2:15pm |

2134 Coyote Willow Drive NE |

1605 sq ft |

$230,000 |

|

2:25-2:35 pm |

1484 Morning glory Rd NE |

3200 sq ft |

$539,000 |

|

2:45-2:55pm |

547 Black Bear Loop |

2996 sq ft |

$450,000 |

|

3:05-3:25pm |

33 Cedar Place NE |

2886 sq ft |

$500,000 |

|

|

|

|

|

If you would like your home to be on the next Sandia Heights home Tour contact Pete Veres at 505-362-2005.

Are you thinking of selling your home? Here is a great article that I found on Kiplinger's that discusses how to find the right Real Estate Agent to sell your home. In a quick summary there are 5 steps to selecting the right agent;

1. Round up good prospects.

2. Ask Tough Questions.

3. Find out who the agent is working for.

4. Make sure your agent has a back up.

5. Sign the right contract.

For more details please read the following article on each 5 steps. http://realestate.msn.com/5-steps-to-picking-the-right-agent-to-sell-your-home

The Spring time is here and if you know anyone that is thinking of selling please contact Sean Hellmann or Pete Veres of the Elite Asset Managment Team with Re/Max Elite. Many of you have had the pleasure to work with us and any referral would be greatly appreciated. You can be assured that your referral will be treated to the same level of service we provided to you. Have a great Spring.

Pete Veres and Sean Hellmann want to share this quick video. Warren Buffet continues to state that SF homes are the Best Investments. Pete Veres, CIAS - Certified Investment Agent Specialist also wants to add that right now multi family units are providing a great ROI & cash flow as prices are extremely low right now and rental demand is high.

Buying is more affordable than renting in 98 out of the nation’s 100 largest metropolitan areas – even in New York, Los Angeles and Boston, according to real estate company Trulia’s rent vs. buy index. To read more from this report from Housingwire please visit this link: http://www.housingwire.com/news/buying-cheaper-renting-nearly-100-major-us-markets-trulia

Pete and I are also seeing this trend in the Albuquerque Real Estate Market. We are working with a number of clients that are purchasing properties where their mortgage payments are less than their current rent. One of the major factors that are allowing lower mortgage payments is that interest rates are at all time lows. If you would like to know more about how you can save money and STOP renting please contact Pete Veres or Sean Hellmann.

The Elite Asset Management Team has some great relationships with lenders with great First Time Buyer loan programs and other affordable loan programs.

Enjoy the article and have a great week!

Pete & Sean

Displaying blog entries 1-10 of 14