RE/MAX National Housing Report for May 2019

Home Sales Accelerate While Inventory Hits 34-Month High

DENVER – May home sales ticked slightly higher year-over-year, ending a 9-month streak of declines, according to the RE/MAX National Housing Report. At the same time, inventory grew for the eighth consecutive month, representing the most units for sale since August 2016 in the report’s 54 metro areas.

Homes sold quickly, as evident in the Days on Market average of 47 – the second-fastest May average in the 10-year history of the report. And home sales increased 15.3% from April to May – the second-highest April-May jump in report history.

Home sales were up 0.4% over May 2018 - the first year-over-year gain since July 2018. The number of homes for sale increased 4.9% year-over-year to set a report record for the highest May growth. However, based on the pace of home sales, May’s 2.6 Months of Inventory was down compared to April’s 2.8 months and the 2.9 months of May 2018.

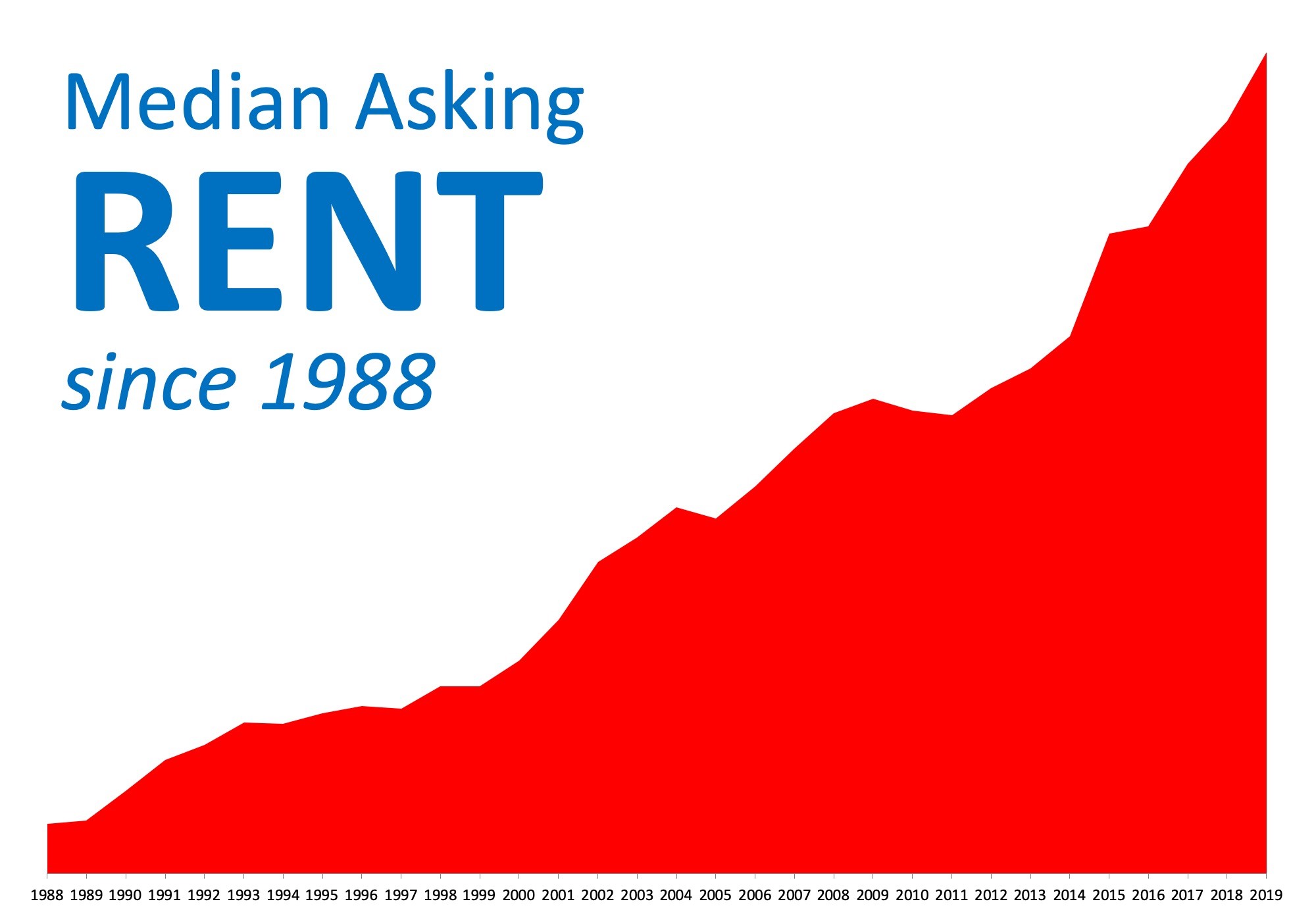

The Median Sales Price of $259,500 was up 3.4% year-over-year, representing the lowest May increase since 2011.

“The spring selling season was in full bloom during the month of May, offering both buyers and sellers something to like,” said RE/MAX CEO Adam Contos. “Buyers are generally finding increased selection along with moderating price increases. At the same time, in general, sellers are selling their homes quickly while still enjoying some price gains. Bottom line, the market is operating efficiently right now, and homes are selling, on average, at a good clip.”

Closed Transactions

Of the 54 metro areas surveyed in May 2019, the overall average number of home sales is up 15.3% compared to April 2019, and up 0.4% compared to May 2018. Leading the month-over-month sales increase were Billings, MT at +64.2%, Burlington, VT at +61.6%, and Minneapolis, MN at +35.8%.

Median Sales Price – Median of 54 metro median prices

In May 2019, the median of all 54 metro Median Sales Prices was $259,500, up 3.3% from April 2019, and up 3.4% from May 2018. Three metro areas saw a year-over-year decrease in Median Sales Price: San Francisco, CA at -5.1%, Honolulu, HI at -3.2%, and Billings, MT at -1.6%. Three metro areas increased year-over-year by double-digit percentages: Milwaukee, WI at +14.2%, Boise, ID at +13.6%, and Albuquerque, NM at +10.2%.

Days on Market – Average of 54 metro areas

The average Days on Market for homes sold in May 2019 was 47, down five days from the average in April 2019, and up two days from the May 2018 average. The metro areas with the lowest Days on Market were Omaha, NE at 25, and San Francisco, CA and Denver, CO, both at 26. The highest Days on Market averages were in Augusta, ME at 106, Miami, FL at 87, and Hartford, CT at 84. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 54 metro areas

The number of homes for sale in May 2019 was up 4.5% from April 2019 and up 4.9% from May 2018. Based on the rate of home sales in May 2019, the Months Supply of Inventory decreased to 2.6 from 2.8 in April 2019, and decreased compared to 2.9 in May 2018. A six months supply indicates a market balanced equally between buyers and sellers. In May 2019, of the 54 metro areas surveyed, only Miami, FL at 6.2 reported a months supply at or over six. The markets with the lowest Months Supply of Inventory were Boise, ID at 1.2, Omaha, NE at 1.3, and Manchester, NH and San Francisco, CA, both at 1.4.

Feel free to contact me and I can help break down exactly what these numbers mean for our local market and for your neighborhood. And lastly, If you or anyone you know is thinking of buying or selling a home - please call or email me. I'm here to help!

Peter Veres

Associate Broker,CRS,ABR,CLHMS,SRES

Elite Asset Management Team - RE/MAX Elite

Cell: 505-362-2005