In a real estate market where home prices are rising, many have begun to reexamine the idea of buying a home, choosing instead, to rent for a while. But often, there is a dilemma: should you keep paying rent, knowing that rent is rising too, or should you lock in your housing cost and buy a home?

Let’s look at both scenarios and analyze the pros and cons of each:

Renting

With the housing market crash in 2008, many homeowners lost their homes and became renters. According to Iproperty Management, “the number of households renting their home … rose from 31.2% of households in 2006 to 36.6% in 2016”.

Some choose to rent because it is more convenient for their lifestyle. Those whose job requires frequent moves need the flexibility that a 6-12 month lease agreement gives them so they can move to their next assignment!

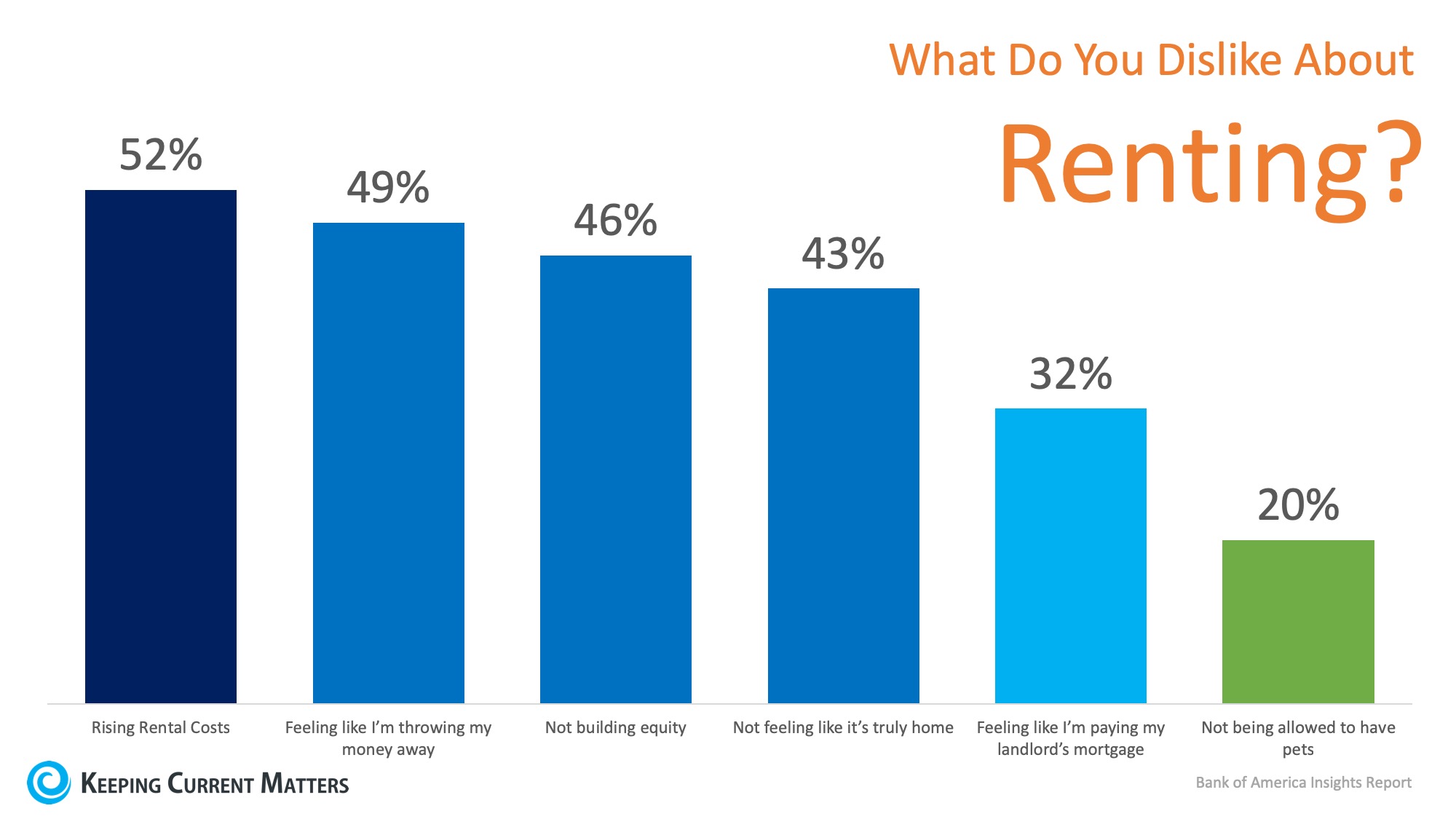

Many renters believe that renting is cheaper because they do not have to pay for maintenance and repairs. (Not true! Landlords work those expenses into your rent and other fees). Another reason many rent is that they feel like they cannot afford the down payment and closing costs required to buy a house, due to their inability to save much after paying their monthly expenses.

That can be true! Nearly 1 in 4 renters spend at least half their household income on rent. In 2017 the “severely” burdened renters’ rate was 24.7% with 24.9% reporting they were “moderately” burdened.

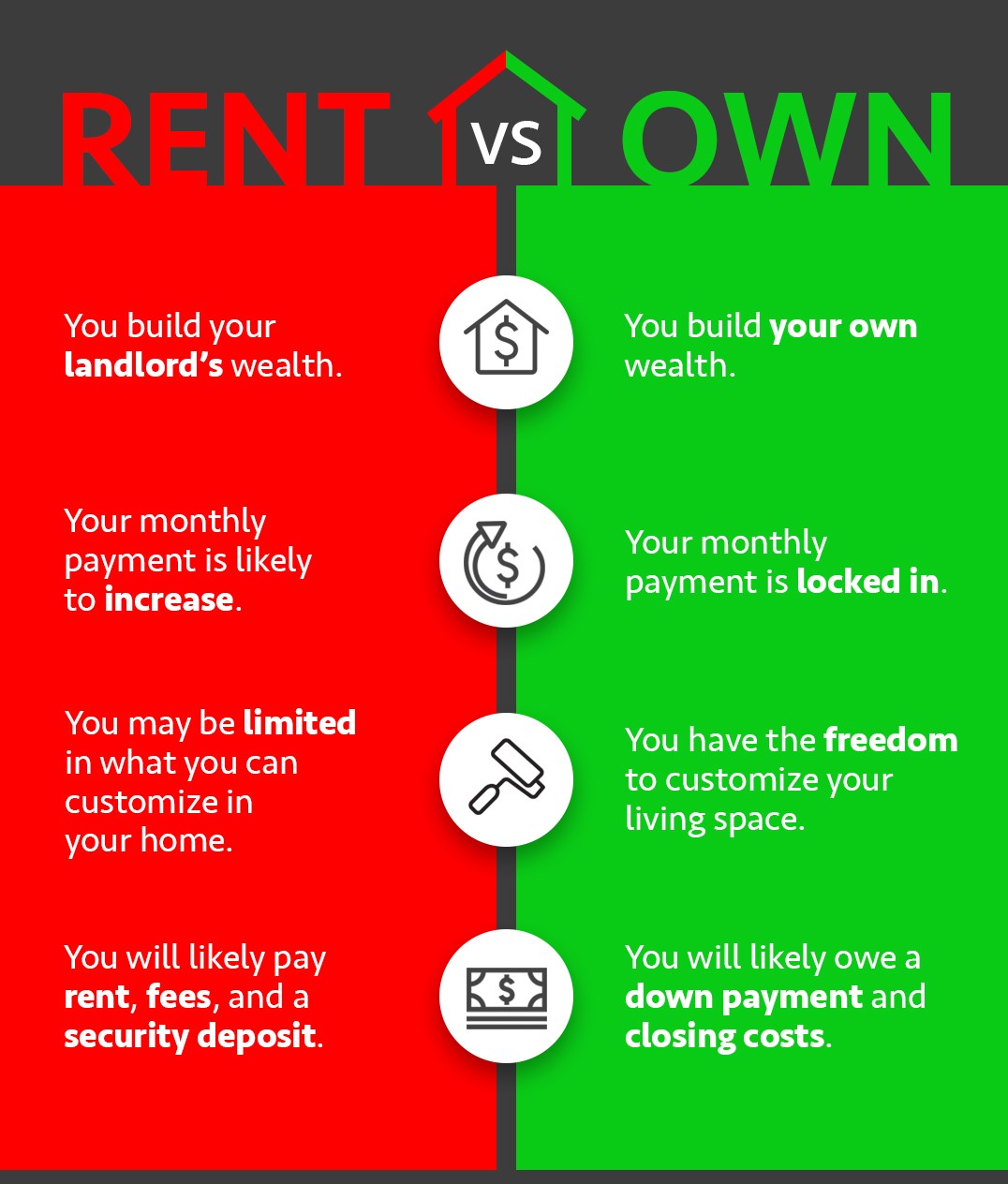

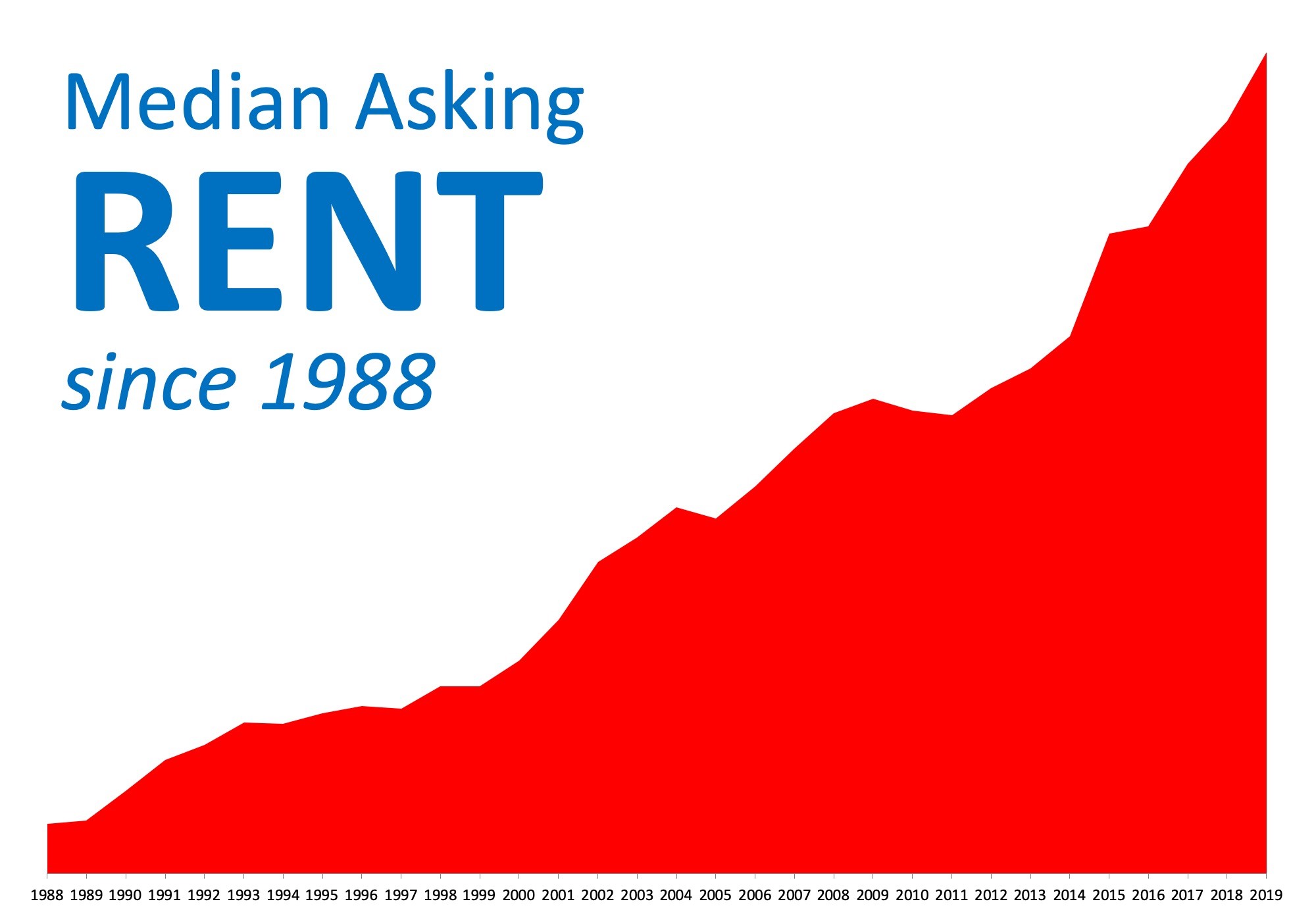

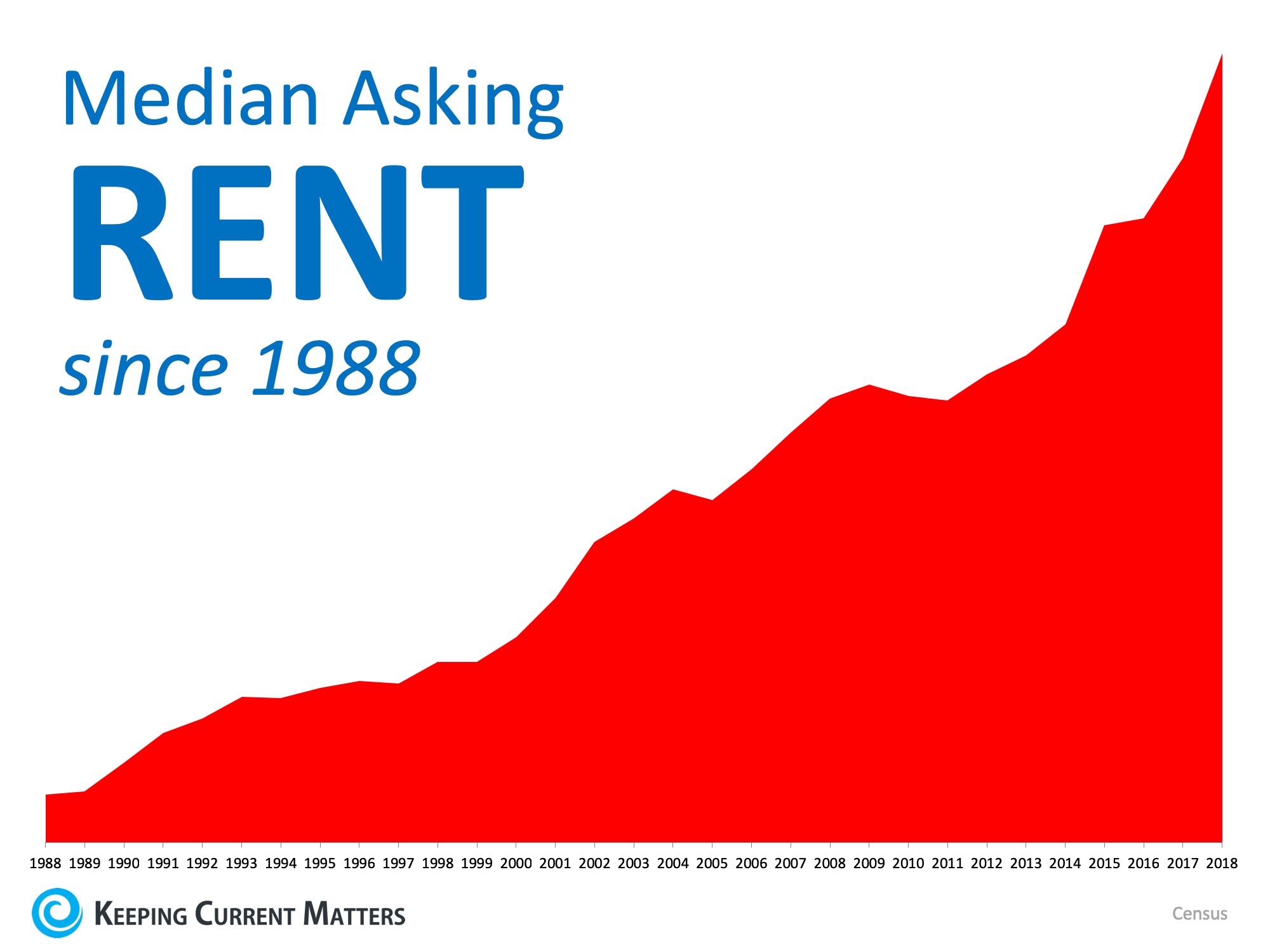

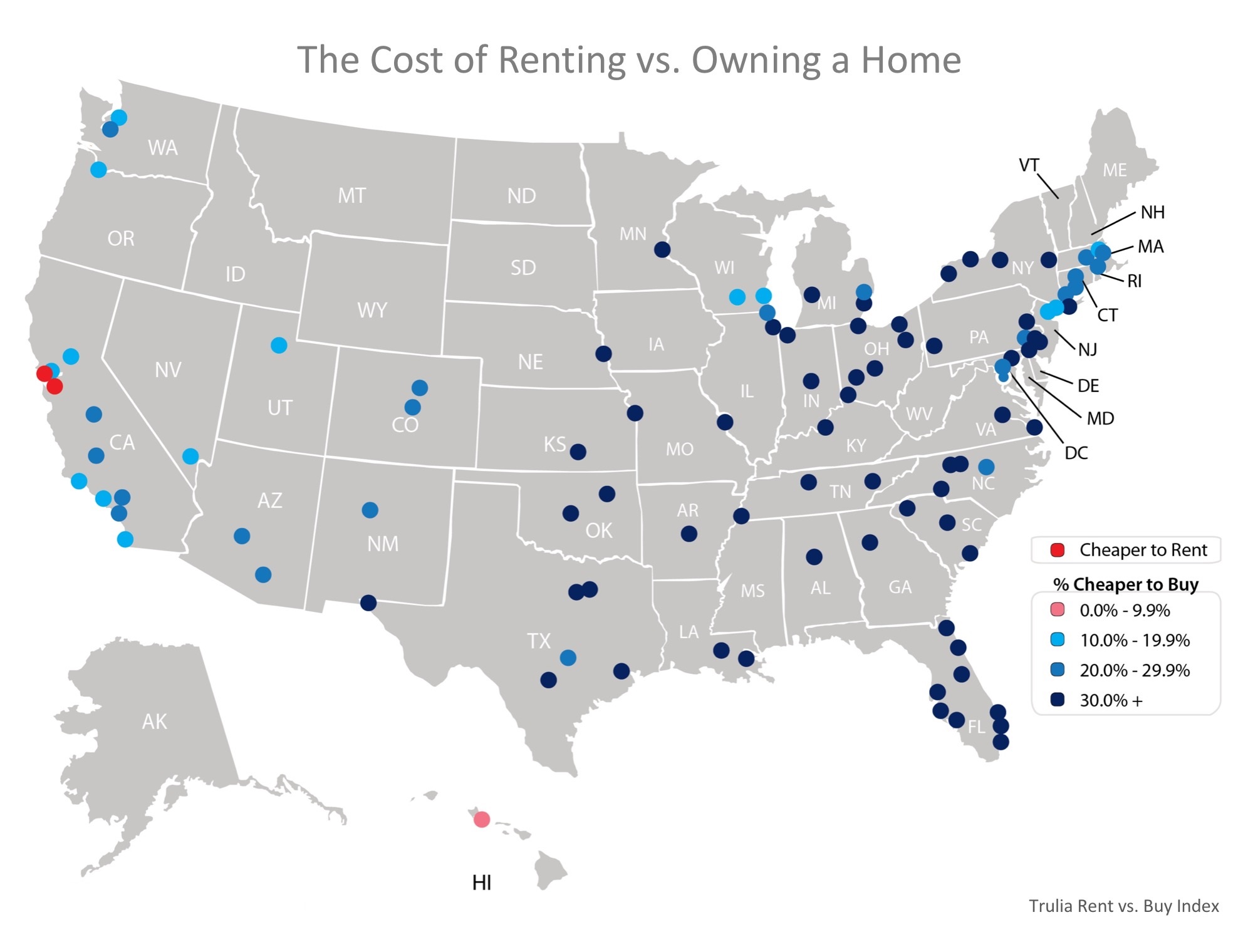

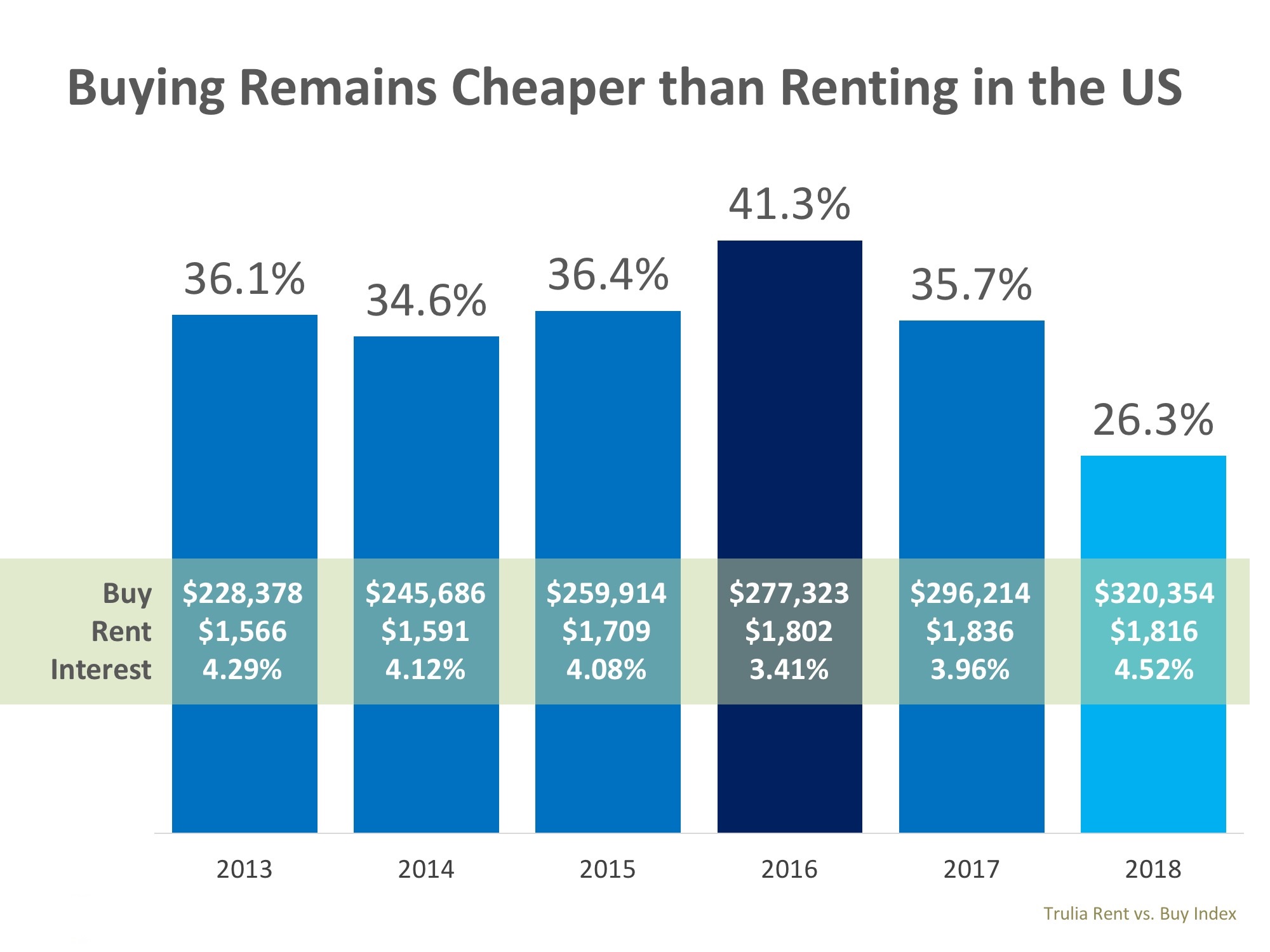

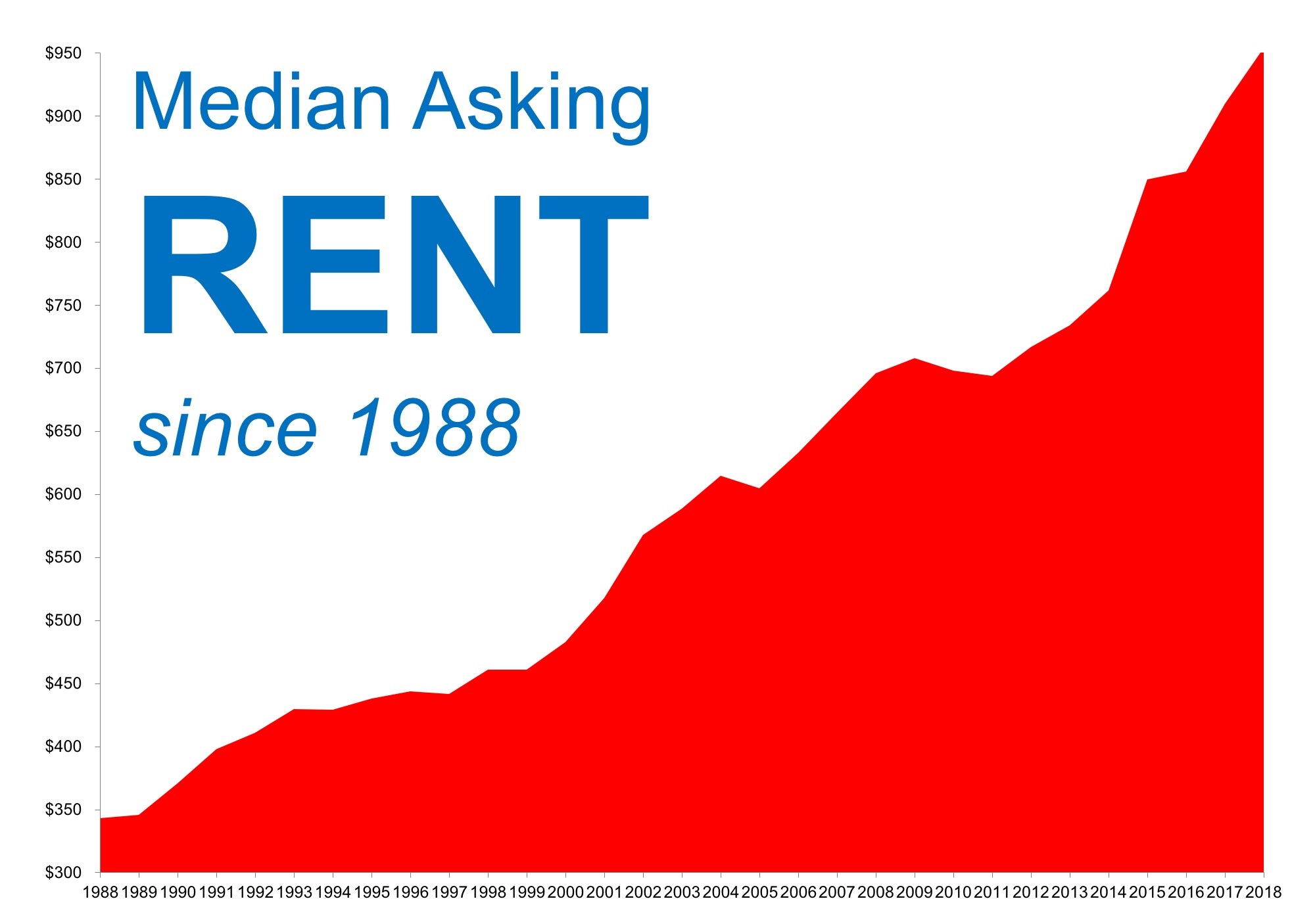

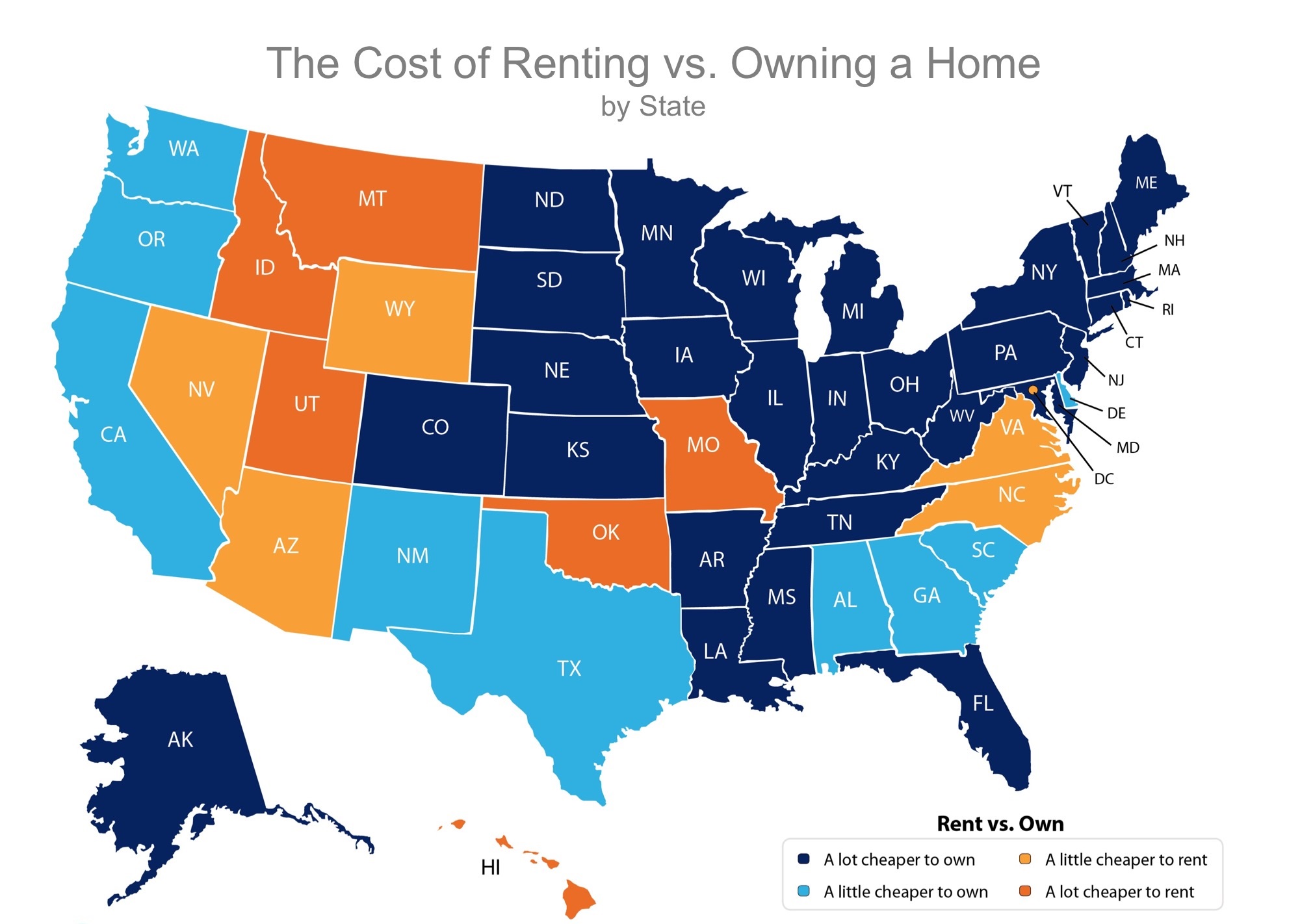

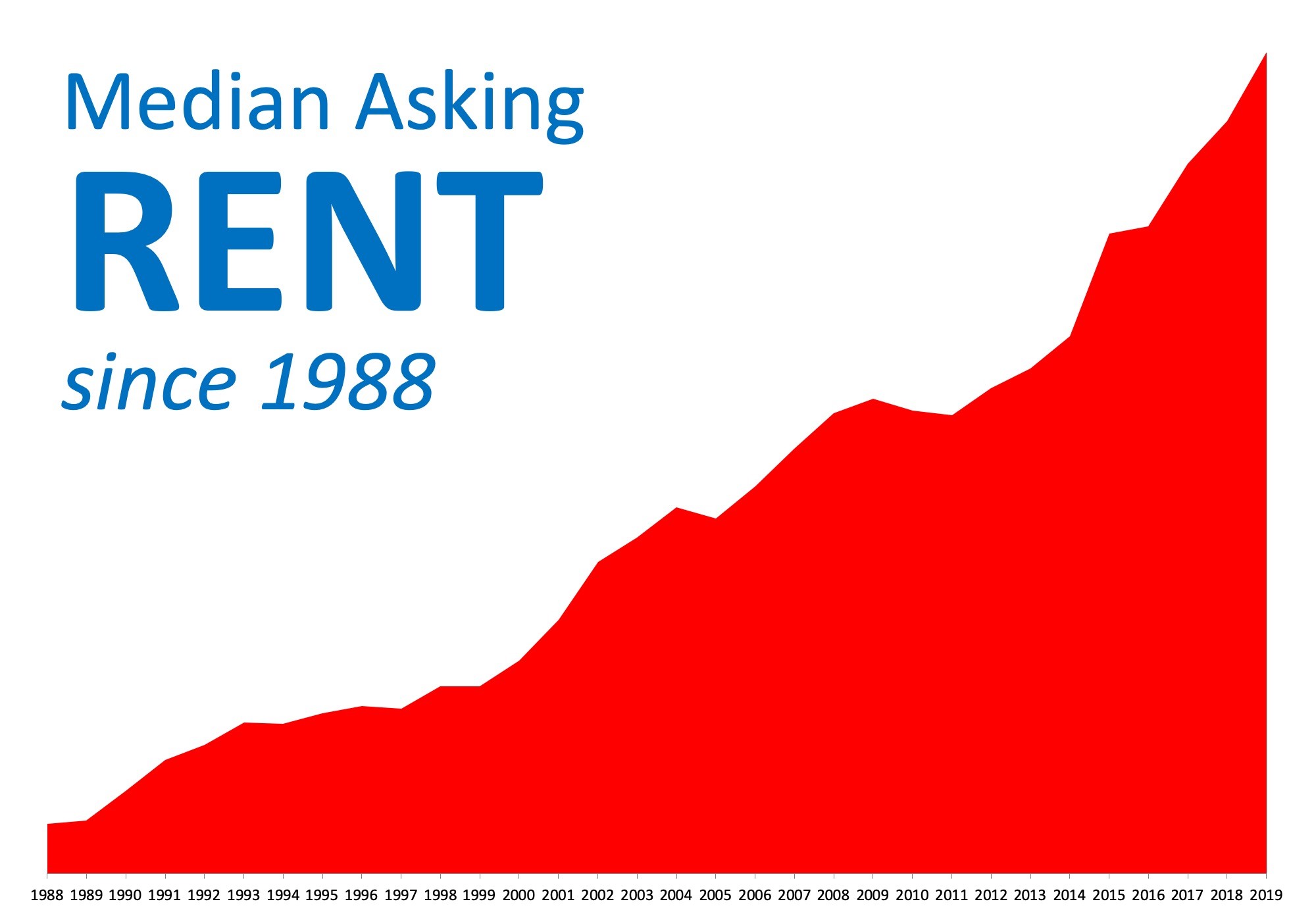

Renting also brings some financial disadvantages. Homeowners can take advantage of tax deductions that let them claim their property taxes and mortgage interest. Additionally, there is a big risk that your rent will go up every time you renew your lease, as we know the median asking rent has been increased steadily since 1988!

One of the major challenges with renting is that you don’t have a space to call your own. When you rent, you are paying your landlord’s mortgage, and therefore they are the beneficiaries of the equity gained from paying that mortgage.

Now let’s explore the other side: Homeownership

In the past, we have mentioned the many financial and non-financial benefits of becoming a homeowner. So, let’s just focus on the one big difference between renting and owning, the ability to lock in your housing cost!

Assuming you will have a fixed-rate mortgage, your costs are predictable! You will know exactly what your mortgage payment will be for the next 15-30 years. The homeownership rate in 2018 was 64.4%, and has been on the rise. Those households locked in their housing cost rather than wait for their landlord to raise their rent again!

What are the disadvantages of owning a home? Well, it is a long-term financial commitment! It is not easy to pack quickly and move. You will need time and good planning to do it in a short amount of time.

You need to save your money! Getting a mortgage requires a down payment, closing costs, and moving expenses. Again, that will require some savings and planning!

Unless you have a homeowner’s association (HOA) (and you pay an HOA fee) or a home warranty, you will be responsible for maintenance and taking care of the home. This may range anywhere from regular landscaping to major repairs.

Bottom Line

Like everything in life, there are pros and cons. What is better for you depends on your situation! If you are interested in becoming a homeowner and want to discuss the pros and cons, contact a local real estate professional that can help you review your current situation!

Meet with a realtor like Pete Veres, CRS – Certified Residential Specialist & ABR – Accredited Buyers and Seller Representative who can help you navigate thru the process and get the job done for you. He can provide you with a Free Market analysis when you are ready. Pete Veres has had over 25 years of Sales & Marketing experience, excellent negotiating skills and a superb track record.

You can contact him by calling or texting him at 505-362-2005 or by emailing him at [email protected].

He has a great website full of the latest information at www.NMElite.com

Here are also some Free Sellers resources. VIP-Seller-Resources