How Bad Will It Be? Why the Spring Housing Market Will Be ‘Miserable’ for Homebuyers

Homebuyers had better be ready to suit up for battle.

Any buyers—or wannabe buyers—who thought last year’s meteoric jump in home prices was rough should be prepared for this spring could be even worse. A hellish trifecta of fast-rising housing prices, increasing mortgage rates, and record-low inventory of homes for sale is likely to present a brutal spring real estate market for those looking to purchase a new home.

“For the buyers, it’s going to be miserable,” predicts Mark Zandi, chief economist at Moody’s Analytics. “We’re going to see a lot fewer home sales this spring. … In many communities, they just don’t have something to sell.” Pete Veres with RE/MAX in Albuquerque states “ We have the lowest inventory ever and buyers can expect to pay 10% or even higher over list price in many cases”

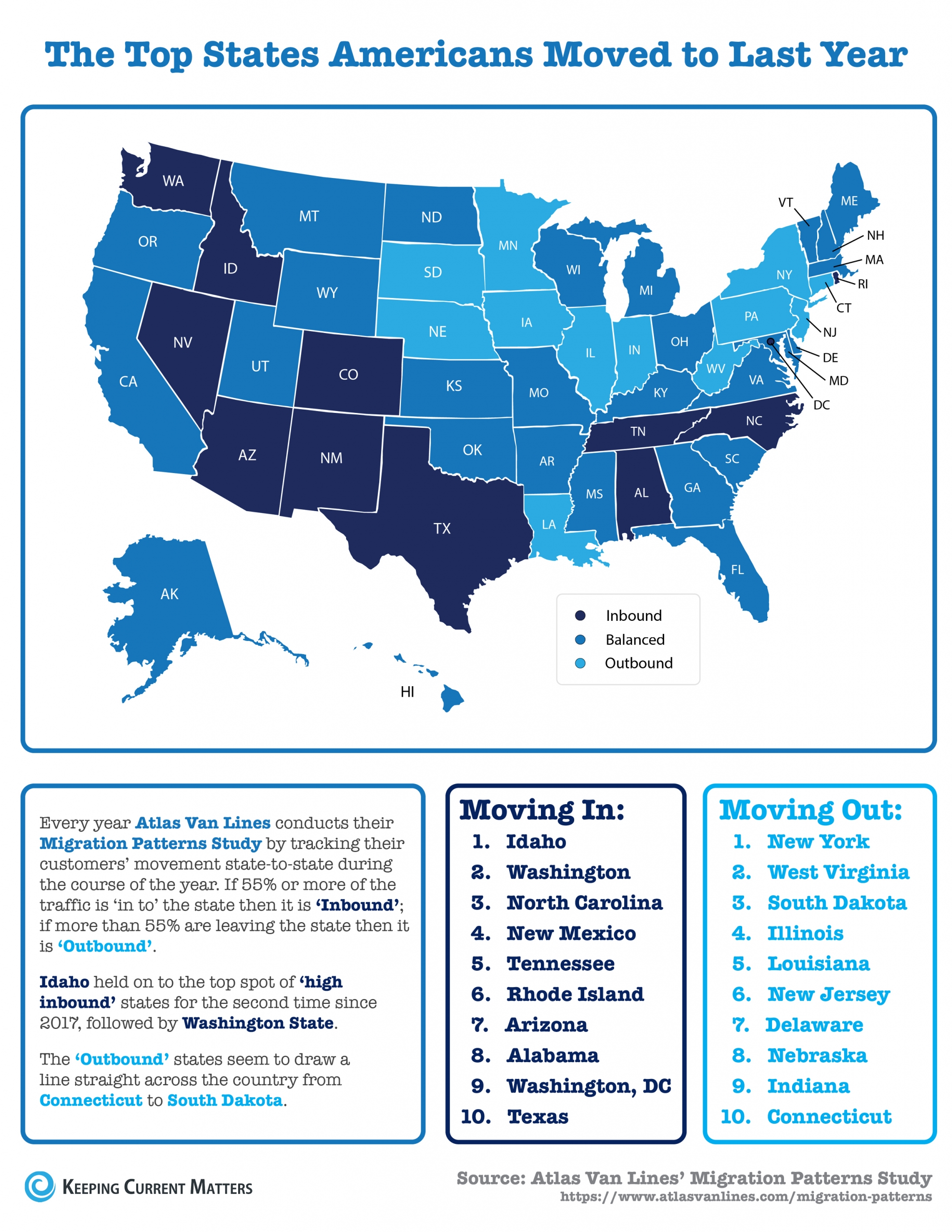

The nation has been mired in a housing shortage for years, but it’s now grappling with the fewest homes for sale ever. The lack of inventory is happening at the worst possible time as more Americans are hitting their prime home-buying years—and not finding anything on the market. The COVID-19 pandemic has only accelerated the problem as buyers sought out more spacious homes.

“It’s going to be a tough market for buyers,” says Gay Cororaton, a senior economist at the National Association of Realtors®. “There are more bidders than houses out there.”

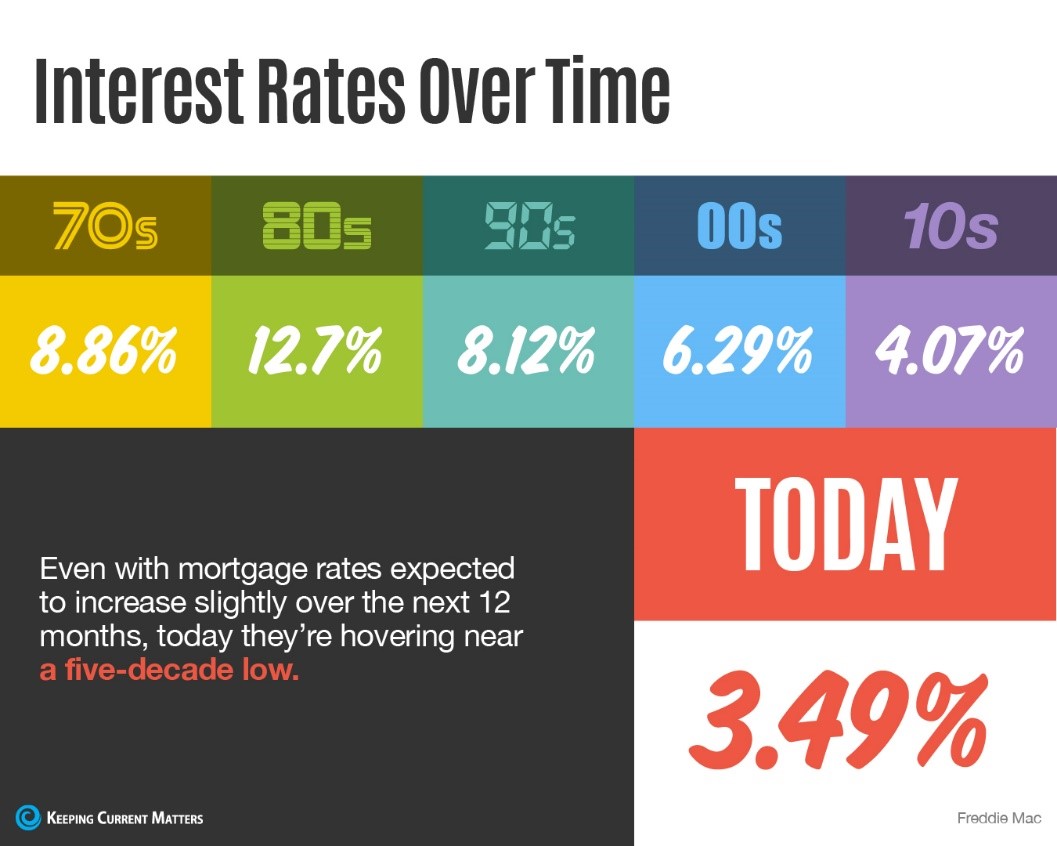

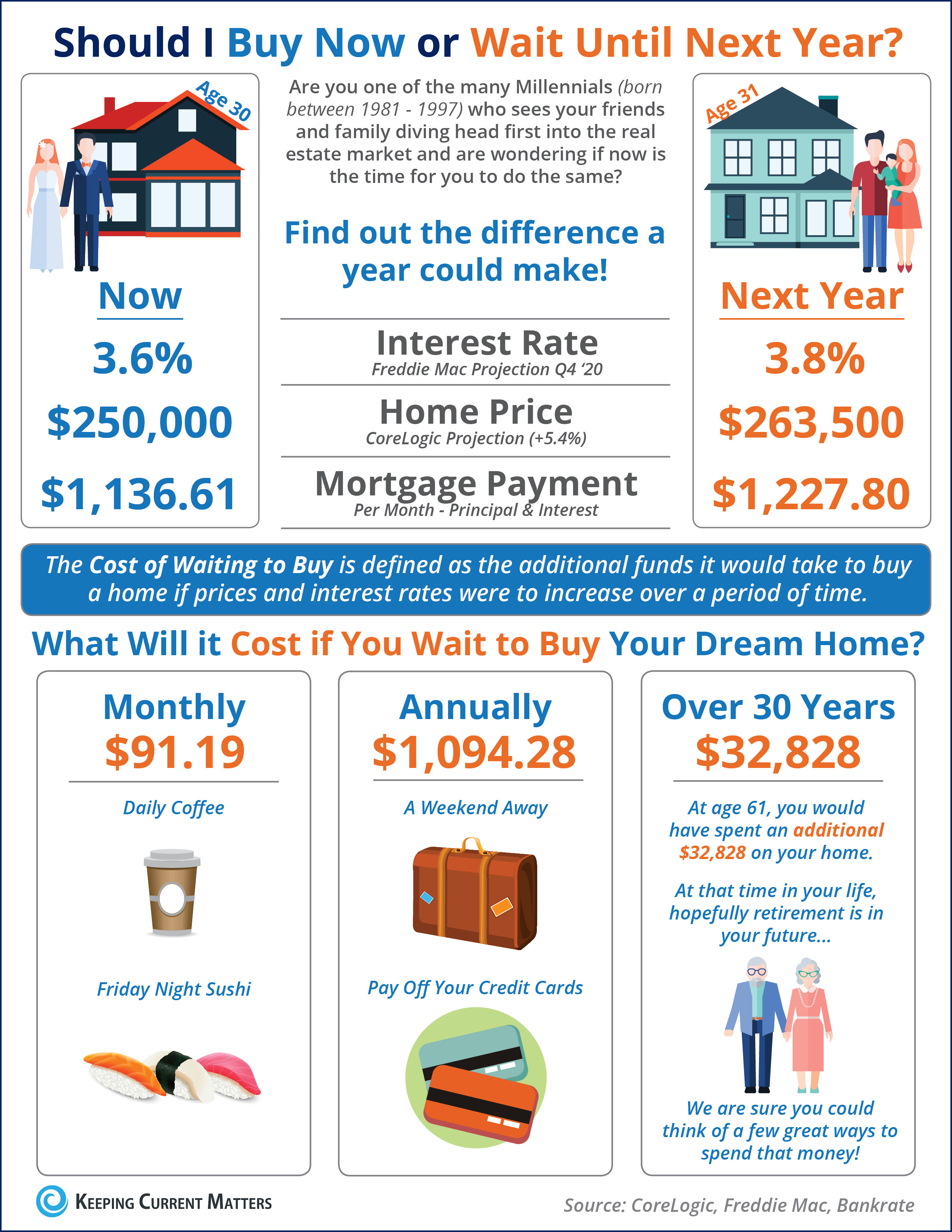

Buyers should expect to pay more for housing as prices continue accelerating by double digits. Last year, all-time-low mortgage rates helped to offset the higher prices. But buyers won’t find that relief this spring now that rates are at the brink of cracking 4%—adding potentially hundreds of dollars each month to a borrower’s mortgage payment.

That doesn’t mean it will be impossible to successfully purchase a home—it just won’t be easy.

The competition from other buyers could thin out a bit as more folks are priced out of homeownership. If there’s less demand, it could mean fewer (or at least less heated) bidding wars that don’t result in mind-boggling offers over the asking price.

“We’re going to see a bit more inventory and somewhat fewer home shoppers,” says Realtor.com® Chief Economist Danielle Hale. She anticipates more homes will go up for sale as the weather warms up. “But that might not be until the later part of the spring.”

Will home prices slow down or continue increasing this spring?

It would make sense that, as mortgage rates rise, home prices would fall or at least stabilize. Logic would suggest that there has to be some limit on how much buyers can afford to spend on housing. Right? Nonetheless, in the short term, instead of prices chilling out, they’ve been shooting up at a faster clip as home shoppers rushed into the market hoping to lock in a home at a low mortgage rate before rates rise even further.

As a result, already high prices leaped 12.9% from a year earlier in the week ending Feb. 19, according to the latest Realtor.com data.

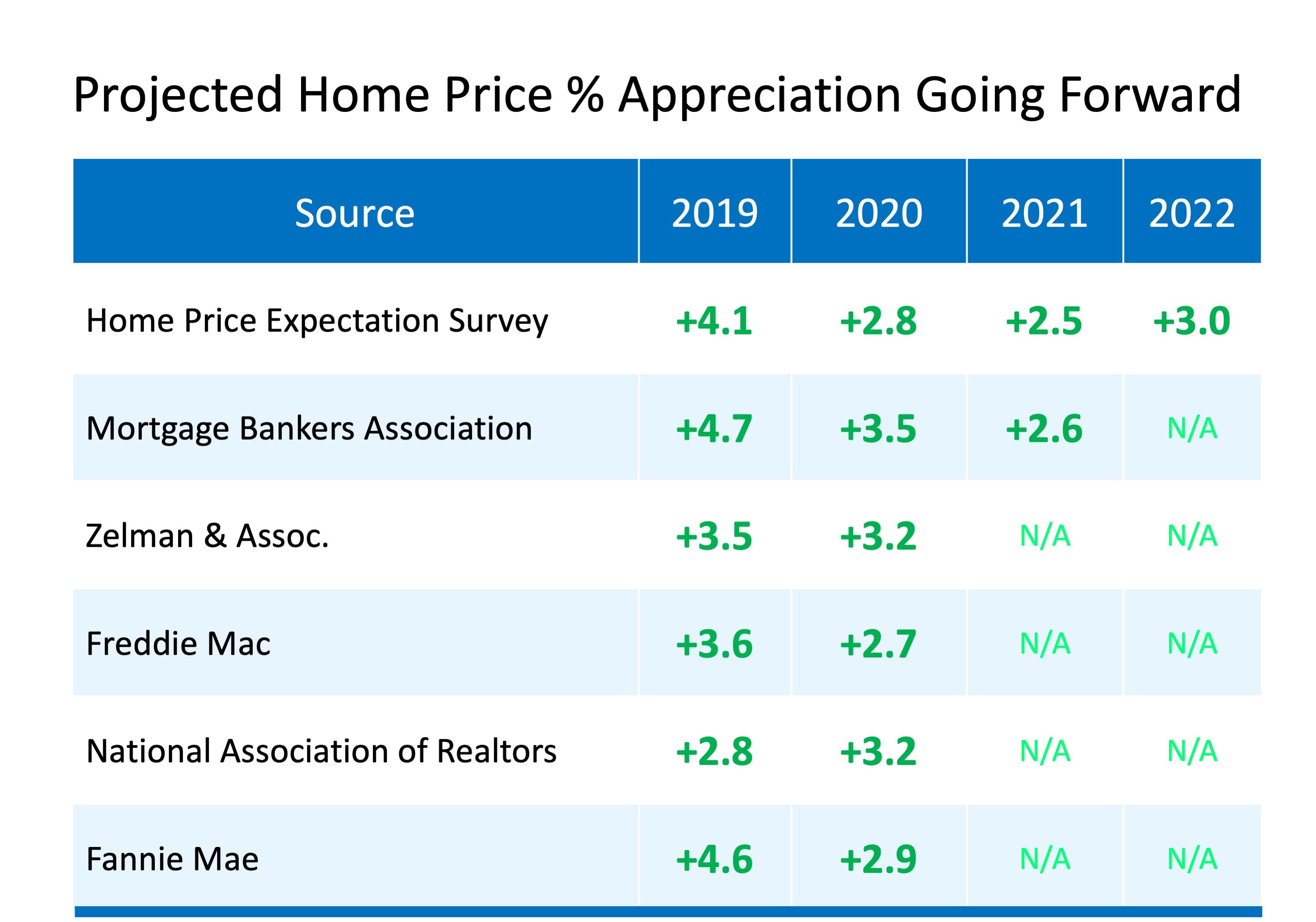

“What’s unclear: Is this the last gasp?” says Len Kiefer, deputy chief economist at Freddie Mac. Price growth was cooling, but then rates began climbing. “Six months down the line … the market may soften a little bit.”

That doesn’t mean prices will fall. It would require a tsunami of newly built homes going up for sale for prices to stop their seemingly inexorable rise. And that doesn’t seem likely as builders have struggled to ramp up construction and the demand for housing just keeps growing.

Kiefer expects it will take between four and five years for it to ramp up enough to meet demand. Builders are still contending with a major shortage of workers, supply chain problems making it harder—and more expensive—to secure building materials and appliances, and inflation further boosting costs.

Normally, more homes begin to trickle onto the market after the holidays. But very little of the past two years has been “normal.” In 2021, more homes didn’t come onto the market until April, says Hale.

“We will eventually see an increase in listings, but it may be a bit later this year,” says Hale. The number of homes for sale was down 28% in January compared with the same time last year, according to Realtor.com data.

Mortgage rates are poised to keep going up

Home prices tend to hog the spotlight as buyers and sellers are generally more concerned with the sticker price than the mortgage interest rate. But not focusing on the mortgage interest rate comes with some peril, as even a fraction of a percentage point can translate into some pretty big bucks over the life of the loan.

Buyers who were pre-approved for mortgages may find that they now qualify for less. Others will be priced out of the market or forced to choose smaller homes, fixer-uppers, or properties in less desirable locations.

For example, surging rates will tack on approximately $220 a month, or $2,640 a year, onto buyers’ monthly payments as rates leaped from a low of around 2.67% in December 2020 to about 4% in February. Some experts predict they’ll continue inching up. While that may not sound drastic, it can add nearly $80,000 over the life of a 30-year fixed-rate loan. Those with larger mortgages will pay considerably more.

(This assumes buyers purchased a $375,000 home, the national median home list price, with 20% down.)

Mortgage interest rates shot up to 3.92% for 30-year fixed-rate loans in the week ending Feb. 17, according to the most recent Freddie Mac data. That’s a little higher than it was in the runup to the start of the pandemic in March 2020. Current rates are 4-4.25%.

“People who are just at the margins of being able to afford a home will think twice about buying,” says NAR’s Cororaton. “The upper-income brackets will be the ones jumping into the market. It just makes it all the harder for the lower-income folks.”

The higher rates are likely to make the inventory crunch even worse. Homeowners who locked in ultralow rates may be reluctant to sell their homes and buy new ones if their monthly housing payments will be higher thanks to those rising rates.

“If they have an interest rate under 3% … that can be a significant increase in their payment—even if they’re downsizing,” says Kiefer. “When inventory is so tight, every prospective home seller has an outsize impact on the market.”

Despite the increases, rates are still historically low. Three years ago, rates were in the mid-4% range. Twenty years ago, they were hovering in the high 6% and low 7% arena. Forty years ago, they were in the mid-17% range.

The one bright spot for buyers will be if sellers begin to cut prices as mortgage rates cut into the budgets of buyers. This could happen in some of the hottest housing markets that saw the largest price increases. But the jury’s still out on if and when this type of correction might happen.

“Mortgage rates will be both friend and foe to buyers this year,” says Hale of Realtor.com. “Monthly mortgage payments will be higher. However, those higher monthly mortgage payments are likely to knock some homebuyers out of the market. You may see somewhat less competition.”

Higher mortgage rates isn’t good news for home sellers

While it’s a great time to list a home, rising mortgage rates are expected to curtail what could have been an even bigger payday for home sellers.

Home sellers expecting “10 buyers lined up at the door” may be disappointed as fewer folks can afford the “stratospheric” home prices, says Moody’s Zandi. That means there may not be as many feverish bidding wars and buyers may not have the funds to go quite so high over the asking price.

Sellers will “get a good price, no doubt about it,” says Zandi. “They’re just not going to get the fortunes they thought they were going to get, because the buyers can’t afford it.”

Most sellers are also homebuyers, looking to move, buy larger abodes, or downsize. So while they may make a tidy sum selling their homes, they still need to find a home and compete in the bidding wars over it just like every other buyer.

“It’s a grind and it’s going to remain a grind,” Keifer says of this year’s real estate market. “The relief will come, but it will be slow.”