SANDIA HEIGHTS STUFF THE TRUCK EVENT

Note: This event will be Saturday October 20th 8:30am to 11:30am, correction...not PM.

Displaying blog entries 1-4 of 4

Note: This event will be Saturday October 20th 8:30am to 11:30am, correction...not PM.

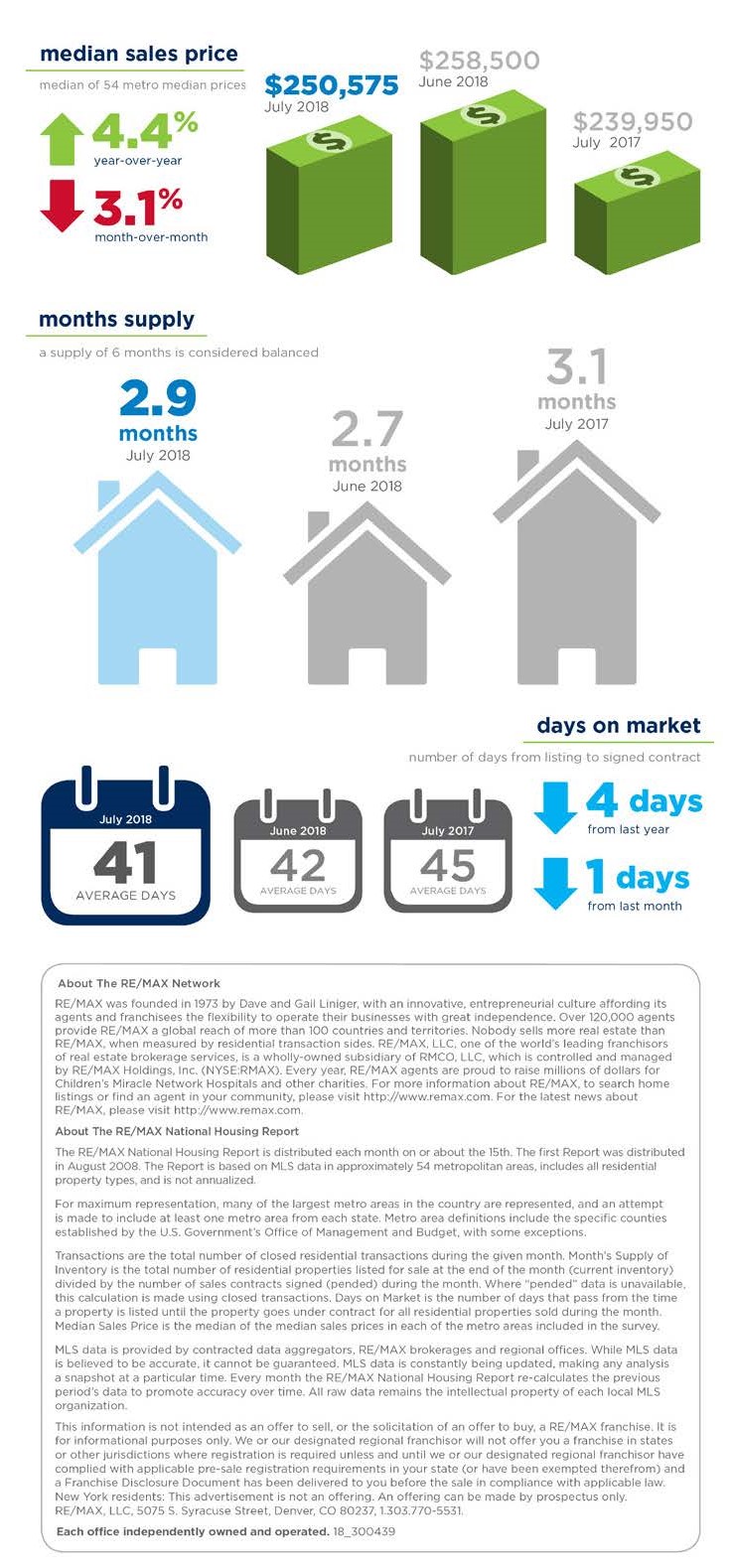

Sales Increase Nearly 2%, Despite Record Prices, Sinking Inventory

DENVER – July home sales rose 1.8% year-over-year, making it the second month of 2018 to post a sales increase year-over-year, according to the RE/MAX National Housing Report.

In the July 2018 report, 37 of the report’s 54 metro areas posted sales increases over July 2017—April was the first month of 2018 where more homes were sold than the same month in 2017. The report also marks the 28th consecutive month of year-over-year price increases.

The Median Sales Price of $250,575 was up 4.4% from July 2017, and represents the third-highest price in report history—topped only by May and June of this year. Months Supply of Inventory was at 2.9 – the smallest total ever recorded for July.

Forty-two of the 54 metro areas reported a year-over-year drop in inventory. The Days on Market dropped to 41 – four days less than July 2017 and one day under the previous nine-year low set in June 2018.

“Because we’ve faced challenging inventories and increasing home prices for some time now, a seasonal slowdown that rebalances the market a bit might actually be a positive in the months ahead,” said RE/MAX CEO Adam Contos. “It could level affordability to some extent and create more opportunity for buyers who’ve been priced out of hot markets.”

Closed Transactions

Of the 54 metro areas surveyed in July 2018, the overall average number of home sales was down 8.7% compared to June 2018, yet increased 1.8% compared to July 2017. Thirty-seven of the 54 metro areas experienced an increase in sales year-over-year, including Billings, MT, +27.4%, Tulsa, OK, +13.2%, Richmond, VA, +12.9% and Pittsburgh, PA, +11%.

Median Sales Price – Median of 54 metro median prices

In July 2018, the median of all 54 metro Median Sales Prices was $250,575, down 3.1% from June 2018 and up 4.4% from July 2017. Only four metro areas saw a year-over-year decrease in Median Sales Price, including Wilmington/Dover, DE, -2.2% and Trenton, NJ, -0.7%. Four metro areas increased year-over-year by double-digit percentages, with the largest increases seen in Boise, ID, +18.8%, Omaha, NE, +12.7%, San Francisco, CA, +12.6% and Salt Lake City, UT, +12.4%.

Days on Market – Average of 54 metro areas

The average Days on Market for homes sold in July 2018 was 41, down one day from the average in June 2018, and down 4 days from the July 2017 average. The metro areas with the lowest Days on Market were Seattle, WA, at 19, Omaha, NE, at 20, and Denver, CO and San Francisco, CA tied at 22. The highest Days on Market averages were in Augusta, ME, at 89, Miami, FL, at 83, Hartford, CT at 76 and New York, NY, at 65. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 54 metro areas

The number of homes for sale in July 2018 was down 0.3% from June 2018, and down 7.8% from July 2017. Based on the rate of home sales in July, the Months Supply of Inventory increased to 2.9 from 2.7 in June 2018, and decreased from 3.1 in July 2017. A 6.0-months supply indicates a market balanced equally between buyers and sellers. In July 2018, all but one of 54 metro areas surveyed reported a months supply at or less than 6.0, which is typically considered a seller’s market. The markets with the lowest Months Supply of Inventory are San Francisco, CA, and Boise, ID, tied at 1.4, Denver, CO, at 1.5 and Salt Lake City, UT, at 1.6.

Feel free to contact me and I can help break down exactly what these numbers mean for our local market and for your neighborhood. And lastly, If you or anyone you know is thinking of buying or selling a home - please call or email me. I'm here to help!

Peter Veres

Associate Broker,CRS,ABR,CLHMS,SRES

Elite Asset Management Team - RE/MAX Elite

www.PeteVeres.com

Cell: 505-362-2005

Office: 505-798-1000

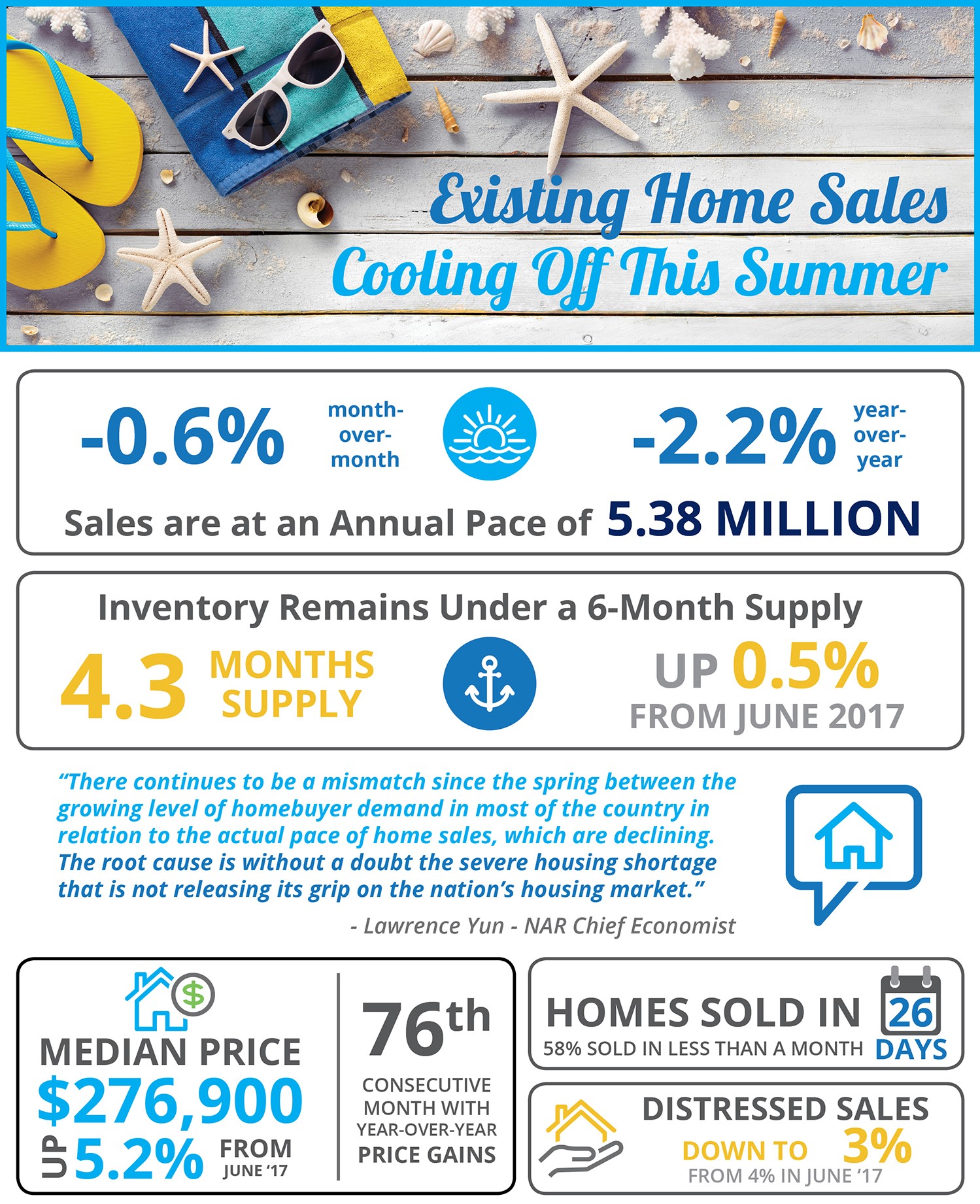

Sales in June down 2.2% from last year, according to the National Association of Realtors’ latest Existing Home Sales Report.

Home inventory still below 6-month supply needed for a normal market despite the 0.5% improvement from last year.

NAR’s Chief Economist Lawrence Yun had this to say: “There continues to be a mismatch since the spring between the growing level of homebuyer demand in most of the country in relation to the actual pace of home sales, which are declining. The root cause is without a doubt the severe housing shortage that is not releasing its grip on the nation’s housing market.”

In our local Albuquerque Market the median sales price is $208,000, up +4.1% from last year this time and months supply is 2.5, down -37% from last year

Meet with a realtor like Pete Veres, CRS – Certified Residential Specialist & ABR – Accredited Buyers and Seller Representative who can help you navigate thru the process and get the job done for you. He can provide you with a Free Market analysis when you are ready. Pete Veres has had over 25 years of Sales & Marketing experience, excellent negotiating skills and a superb track record.

You can contact him by calling or texting him at 505-362-2005 or by emailing him at [email protected].

He has a great website full of the latest information at www.NMElite.com

Here are also some Free Sellers resources. VIP-Seller-Resources

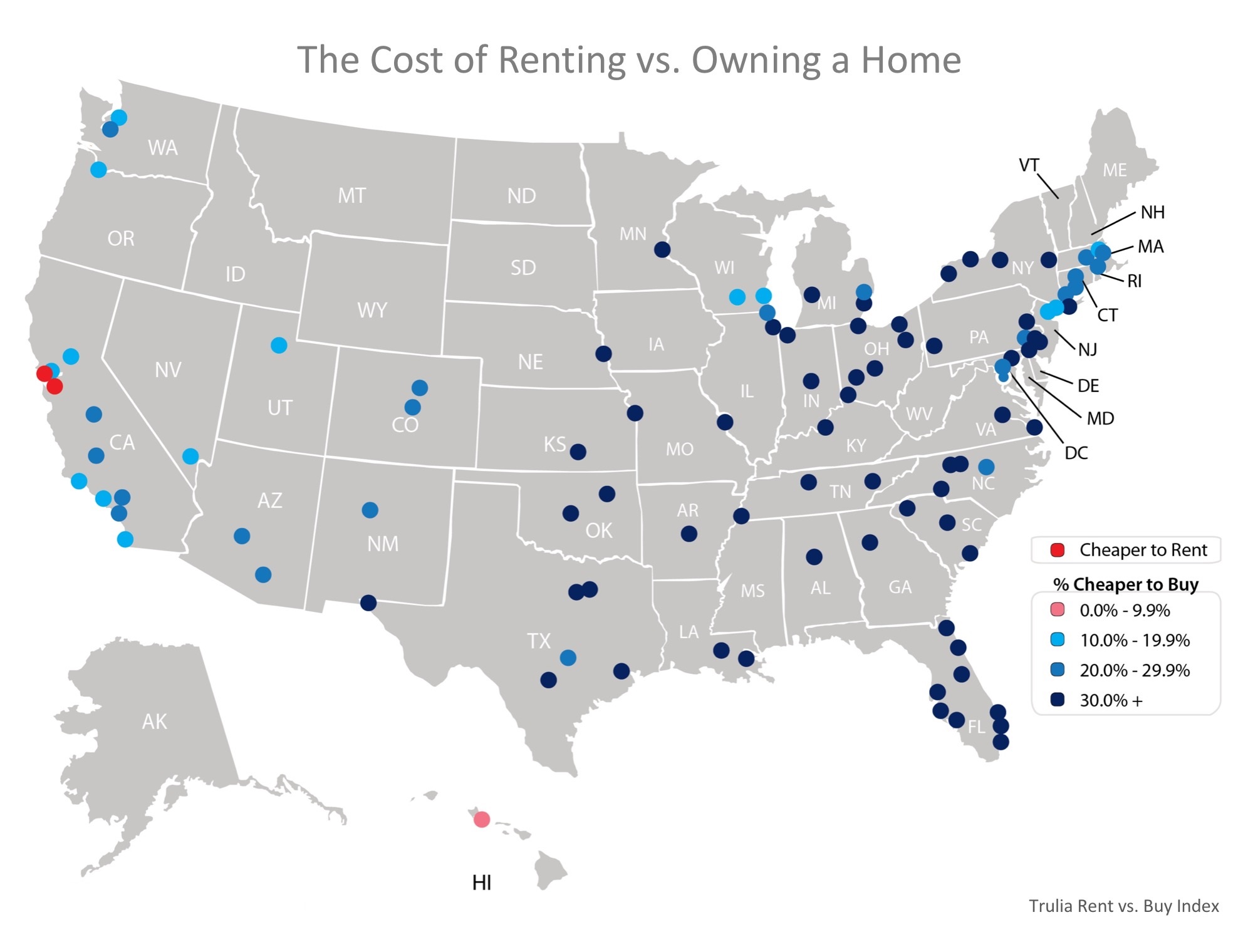

In 98 of the 100 largest metro areas in the United States, it is cheaper to buy than to rent with a 30-year fixed rate mortgage, according to a recent report done by Trulia.

This report is the Rent vs Buy report. The 97 of the 98 metro areas are on a double digit advantage when it comes to how cheap it is to buy vs rent.

The map below shows the metro areas that were studies and how cheap it is to buy rather than rent. The darker the blue, the cheaper it is.

Here’s how Trulia calculates the true cost of rent vs buying.

Trulia includes all assumed renting costs, including one-time costs (like security deposits), and compares them to the monthly costs of owning a home (insurance, mortgage payments, taxes, and maintenance) including one-time costs (down payments, closing costs, sale proceeds). They also assume that households stay in their home for seven years, put down a 20% down payment, and take out a 30-year fixed rate mortgage.

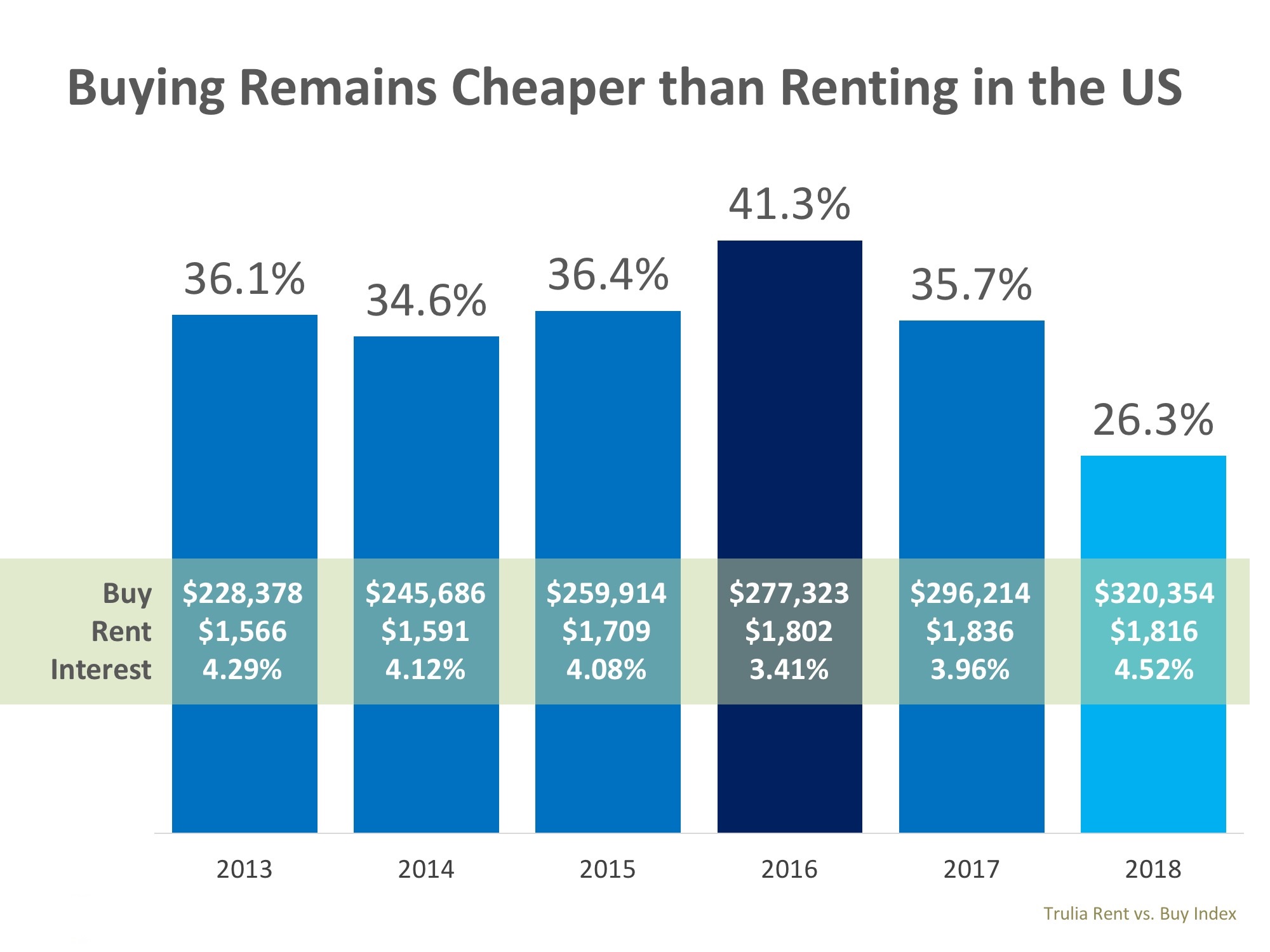

Six year study chart:

It shows the impact of the median home price, rental price, and 30-year fixed rate interest rate used to calculate the ‘cheaper to buy’ metric.

The average mortgage rate back in 2016 was the driving force for making it 41.3% cheaper to buy a home. Rates have been the highest in six years but buying a home remains cheaper.

Cheryl Young, Trulia’s Chief Economist, had this to say,

“One point deserves emphasizing: The ultra-costly San Francisco Bay Area is not a harbinger for the nation as a whole. While renting may outweigh buying in San Jose and San Francisco, it is unlikely that renting will tip the scales nationally anytime soon.”

Aside from being cheaper than renting, owning your own home has a lot of advantages. Home values are always rising and you wouldn’t want to miss out on equity.

Meet with a realtor like Pete Veres, CRS – Certified Residential Specialist & ABR – Accredited Buyers Representative who can help you navigate thru the process and get the job done for you. Pete Veres has had over 25 years of Sales & Marketing experience, excellent negotiating skills and a superb track record.

You can contact him by calling or texting him at 505-362-2005 or by emailing him at [email protected].

He has a great website full of the latest information at www.NMElite.com

Displaying blog entries 1-4 of 4