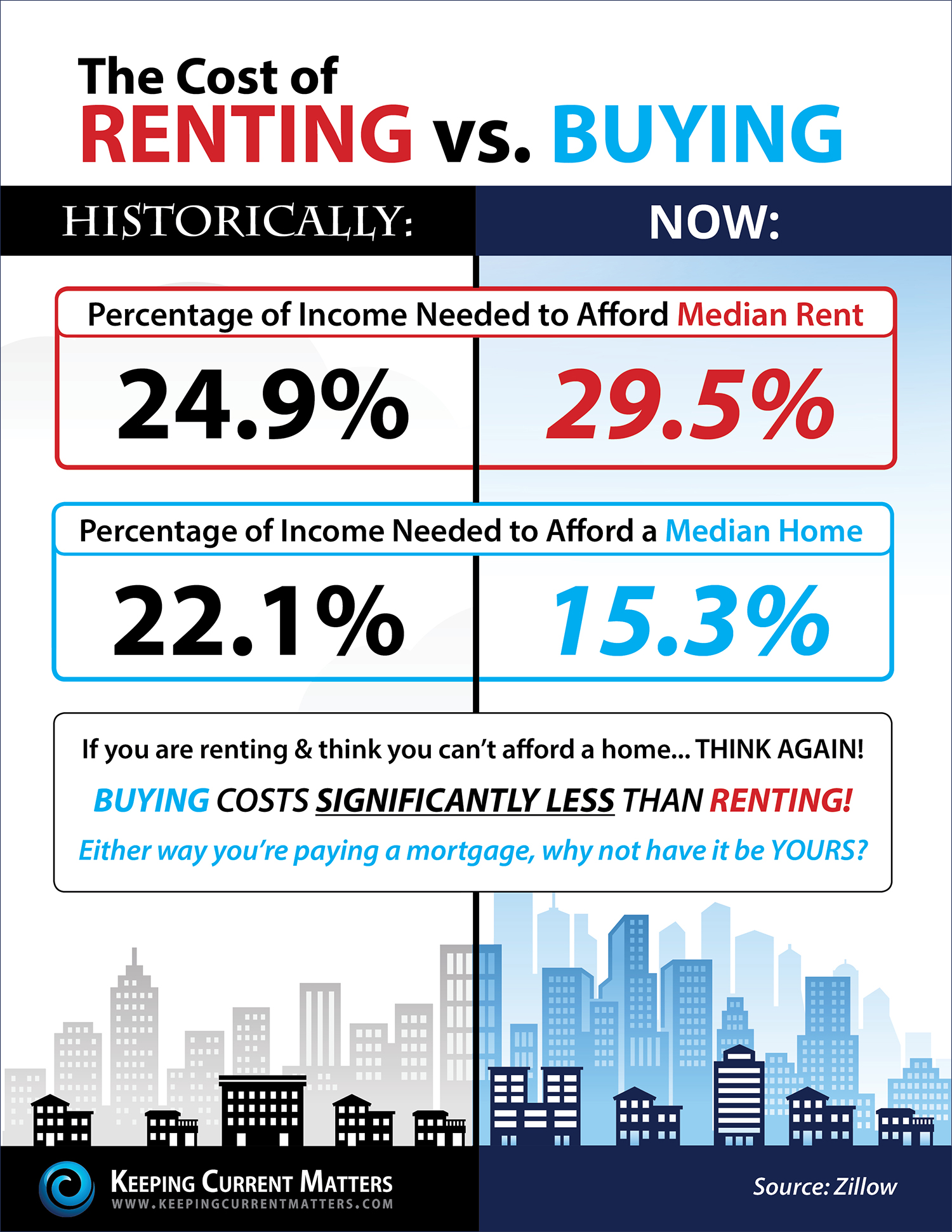

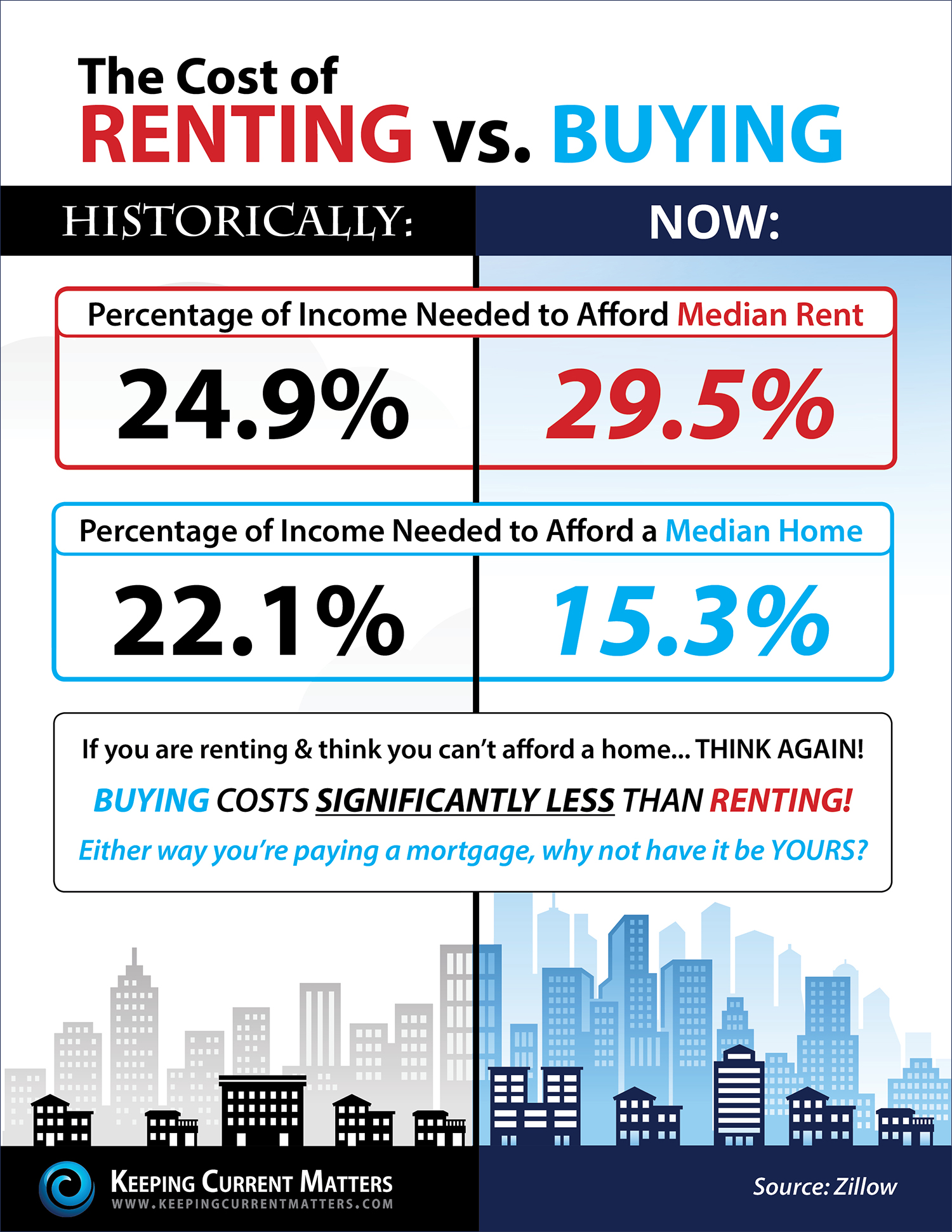

Why RENT when you can BUY?

Most poeople who rent think they can't afford to buy a home. THINK AGAIN! We just closed a client who was rents and they ened up saving $200.00 a month on their rent and the bonus is they Own a Home!

Elite Asset Management Team

Displaying blog entries 211-220 of 240

Most poeople who rent think they can't afford to buy a home. THINK AGAIN! We just closed a client who was rents and they ened up saving $200.00 a month on their rent and the bonus is they Own a Home!

Pete Veres wants to share a quick 60 minute video market update. If you would like a complete Real Estate Market Report please contact me either by email: [email protected] or phone: 505-362-2005.

Pete Veres wants to share a quick Video Market Update for June.

|

||||||

It's Great Time To Buy!Here is your market video with the most recent activity for Albuquerque Real Estate Video Market Update! Please click the link above to view and contact me if you have any questions regarding your next real estate transaction I'd love to assist you with your real estate needs.

|

||||||

Real Estate Video Tips

|

||||||

|

Your home is your castle, but there are also many financial advantages of owning a home. Here are five ways that owning can be better than renting.

1. As a Hedge Against Inflation

Your rent will go up on a regular basis, while your payment on a 30-year fixed mortgage will always remain the same.

Let’s say your monthly rent is $1,800. Assuming inflation (your rent increase) is 3 percent, in five years your monthly rent will be $2,026. By then, you will have paid about $115,000 of your landlord’s mortgage.

2. To Build Your Personal Wealth

Stop paying your landlord’s mortgage. When you own your home, your mortgage amount is going down and your property value is going up.

No other investment, asset or debt is as misunderstood as a home. A home can be a wonderful and lucrative investment, but like any investment, it needs to be regularly reviewed, maintained and, when appropriate, sold. Even if your home is paid off, you still pay costs for repairs and upkeep, taxes and insurance. But like any investment, if you own it long term, take care of it and sell when the market is right, you stand to make a great gain.

3. Tax Savings (Federal and State)

Under Section 163 of the IRS code, interest on loans used to acquire, construct or improve real estate is deductible on up to a $1,000,000 mortgage.

Interest on loans tied to real estate for any reason is deductible on up to a $100,000 mortgage. For example, interest on the first $100,000 of a home equity line of credit (HELOC) is tax deductible.

Let’s say you make $100,000 per year and rent a home for $1,800 per month. You would have to pay taxes on your entire income of $100,000 when you are renting that home. If you purchase a home with a monthly payment of $1,800, you only have to pay taxes on $78,400 of your annual income because the interest you paid on your mortgage can be used as a tax deduction.

4. Asset Diversification

Unlike with a 401(k) or IRA, when you invest in a home you can live in it while the investment grows.

Owning a home over an extended period of time is usually more lucrative than renting. With good planning and execution, you can learn to minimize the cost of homeownership and maximize the ability to create real wealth. Many small business owners have a home office and can use the home office as a tax deduction while they are earning income. Other homeowners will rent out a bedroom and use the rent to pay down their mortgage and gain equity faster.

5. Forced Savings

Monthly mortgage payments lower your mortgage, essentially creating a forced savings account.

In five years with a $1,800 monthly mortgage payment, you will have paid $29,331 of the principal on your mortgage. That would be money in your pocket if you choose to sell. For this example we use a $345,000 mortgage loan amount at a 4.75 percent interest rate, 4.881 percent APR and use a standard amortization table to come up with the principal pay down.

Guest post by Carl Spiteri, Benchmark Mortgage, News Genius

Video Snaphot for our National Housing Report: September 2013. If you would like a Greater Albuquerque Market update or a local neighborhood snapshot please contact Pete Veres: [email protected] 505-362-2005.

National Real Estate Video Snapshot for June 2013

Rising rents and the desire to own again now that the economy is more stable are driving many boomerang buyers to re-enter the market. They also want to jump in before interest rates and home prices climb too much higher.

But how soon they can jump back in will depend on the type of loan they had as a previous home owner. For example, boomerang buyers who had FHA loans may need to wait only three years if they can prove that a hardship, such as job loss or death of a wage earner, led to their foreclosure or short sale.

Borrowers have typically been required to wait five to seven years to qualify for another loan, but mortgage giants have begun to change their rules to allow home owners who underwent a foreclosure or short sale to qualify sooner. Those who underwent a short sale will likely qualify the soonest. However, not all lenders are participating, so borrowers will need to shop around.

Freddie Mac’s wait time is usually four years following a short sale or deed-in-lieu, and seven years after a foreclosure. Fannie Mae may require a seven-year wait for a foreclosure, but only a two-year wait following a short sale as long as the borrower can provide a 20 percent down payment.

The following markets have the highest share of boomerang buyers, according to John Burns Real Estate Consulting:

From: Daily Real Estate News | Tuesday, July 16, 2013

I wanted to take a moment and share the latest Greater Albuquerque Market Update with you for March 2013.

We are seeing some good news for sales of single family detached homes in the Greater Albuquerque Area. Sales are up 12.75% from the same period last year. March marks the fifteen month where the current month’s sales exceeded the same month the prior year. Pending sales of single-family detached homes rose 8.52% from the previous year and increased 21.36% from February 2013.

Now is the perfect time to take advantage of our market, especially buying as interest rates are starting to edge up.

We also have several programs available for you if you are looking to sell and either move up or downsize. The time could be now.

Please give me a call at 505-362-2005 to discuss any questions you may have or any friends or family that will need my help.

Thank you for your time and consideration.

Best Regards,

Pete Veres

505-362-2005

What are the pros and cons of a deed-in-lieu and foreclosure?

A deed-in-lieu is where you give the deed to your house to your lender and the lender does not foreclose. Thus, the concept "in lieu," meaning "instead of."

The pros of a deed-in-lieu include unloading your property with little hassle; not having to suffer the embarrassment of having the sheriff hold a foreclosure auction right on your front porch (which is the practice in many parts of the country); and you can reach agreement with your lender in advance as to how much money (if any) you will have to pay the lender.

In many deed-in-lieu arrangements, while the lender will agree to take the house back and cancel your loan, sometimes it comes at a cost, i.e., you will have to pay something for this. Compare this to a foreclosure, where you won't know what the house will sell for, and in many states, like New Mexico, you can be sued for the difference between what you owe and what the house sold for (called a deficiency judgment).

One more positive: Congress just extended the "forgiveness of debt" law for 2013, so in many situations you will not have to pay tax on the debt that was forgiven when the lender took the deed-in-lieu.

Compared to a foreclosure, I cannot think of any negatives by doing a deed-in-lieu. However, if a short sale is at all possible, I would opt to go that route instead of giving the deed to your lender. But whether you lose your house by way of a foreclosure or a deed-in-lieu, or enter into a short sale, your credit will be impacted.

Quick Easy Way to Preview 4 homes without any pressure.

Tour starts at 2:00pm Sharp! April 28, 2013

Please meet us at 2:00pm and then we will head off to the second home at 2:15. We tour 4 homes and spend about 10 minutes at each. We want to make this quick and easy and if your would like to go back to one of these homes or any others just let us know and we will set up an appointentment thats works best for you.

Sandia Heights Home Tour

Elite Asset Management Team – RE/MAX Elite

Hosted by: Pete Veres 505-362-2005

|

Time |

Address |

Size |

List Price |

|

2:00-2:15pm |

2134 Coyote Willow Drive NE |

1605 sq ft |

$230,000 |

|

2:25-2:35 pm |

1484 Morning glory Rd NE |

3200 sq ft |

$539,000 |

|

2:45-2:55pm |

547 Black Bear Loop |

2996 sq ft |

$450,000 |

|

3:05-3:25pm |

33 Cedar Place NE |

2886 sq ft |

$500,000 |

|

|

|

|

|

If you would like your home to be on the next Sandia Heights home Tour contact Pete Veres at 505-362-2005.

Displaying blog entries 211-220 of 240