Do 46 Million Millennials Know They Are Mortgage Ready?

Many have written about the millennial generation and whether or not they, as a whole, believe in homeownership as part of attaining the American Dream.

Millennials have taken longer to obtain traditional milestones than the generations before them, such as getting married, having kids, and buying a home. However, that does not mean that they do not still aspire to achieve those things.

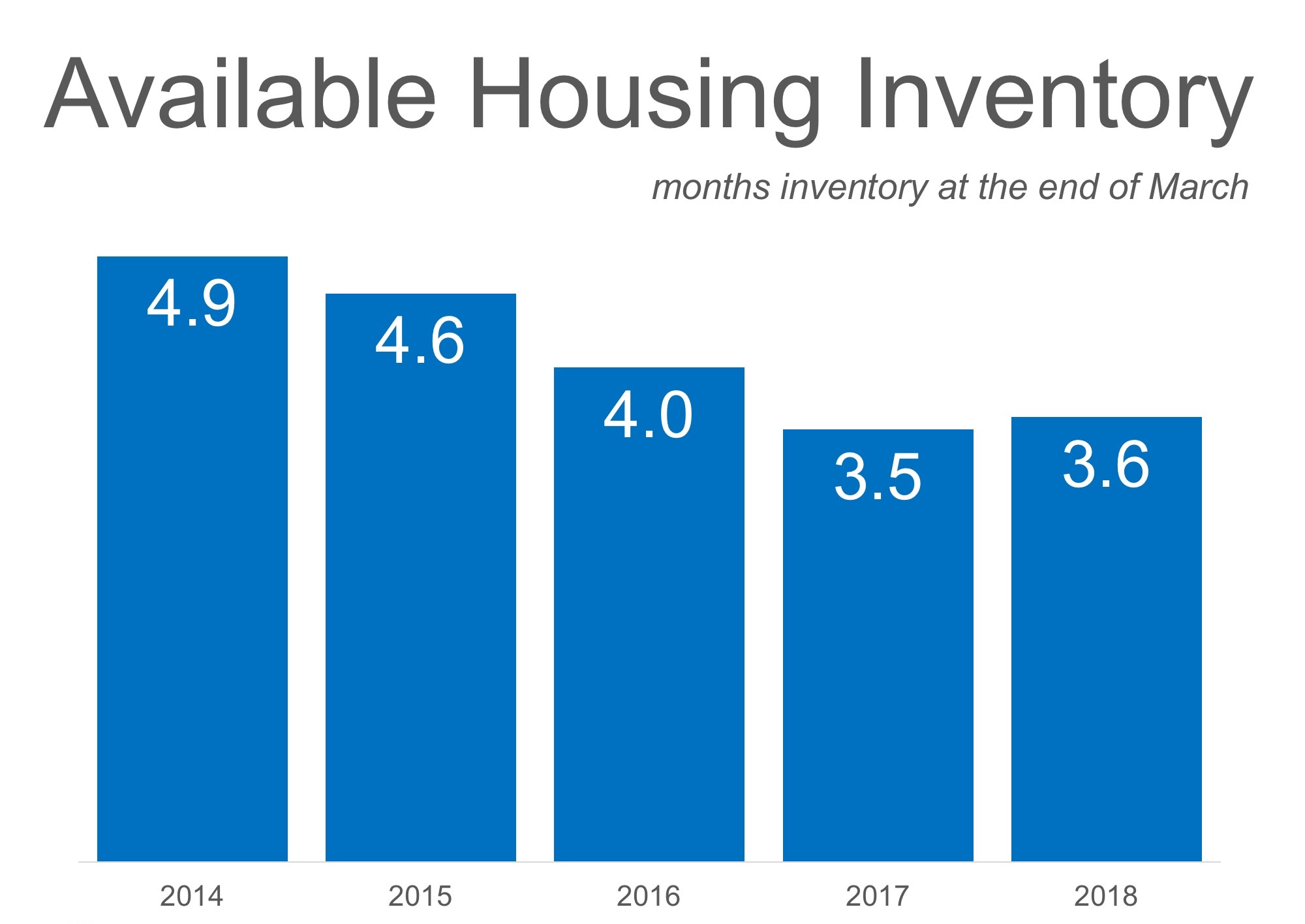

History shows that people tend to buy their first home around age 30. Nearly 5 million millennials will turn 30 in the next two years. This will continue to fuel demand for housing.

This is also one of the many reasons why the millennial homeownership rate has continued to grow over the past few years. 48.4% of Americans between the ages of 30-34 now own a home.

There are over 46 million millennials (33% of the generation) who are considered “Mortgage Ready”,meaning they meet the qualifications to be approved for a mortgage today!

- a FICO Score ≥ 620

- a Back-End Debt to Income Ratio ≤ 25%

- no Foreclosures or Bankruptcies in the last 7 years

- no severe delinquencies in 1 year

Rob Chrane, CEO of Down Payment Resource, commented on the findings of the report,

“We now know there are millions of buyers with the income & credit necessary to qualify to buy a home. The biggest question is:

Do they know it? …Unfortunately, many renters don’t investigate homeownership simply because they don’t believe it’s an option.”

The good news is that more and more millennials are realizing that they can afford a home now. Even so, more can be done to increase awareness of low down payment programs to attract even more of this generation.

New data from realtor.com shows that in December, millennials accounted for 42% of all new home loans originated in the month. This is more than any other generation.

Bottom Line

If you are one of the many millennials who may be “Mortgage Ready” but are unsure what your next steps should be, contact a local real estate professional who can help guide you on your path to homeownership.

Meet with a realtor like Pete Veres, CRS – Certified Residential Specialist & ABR – Accredited Buyers Representative who can help you navigate thru the process and get the job done for you. Pete Veres has had over 25 years of Sales & Marketing experience, excellent negotiating skills and a superb track record.

You can contact him by calling or texting him at 505-362-2005 or by emailing him at [email protected].

He has a great website full of the latest information at www.NMElite.com