ABQ housing market ends 2017 on a high note

ABQ housing market ends 2017 on a high note

from GAAR News

Albuquerque, N.M. — The metro Albuquerque housing market closed out 2017 on a high note, according to the Greater Albuquerque Association of Realtors.

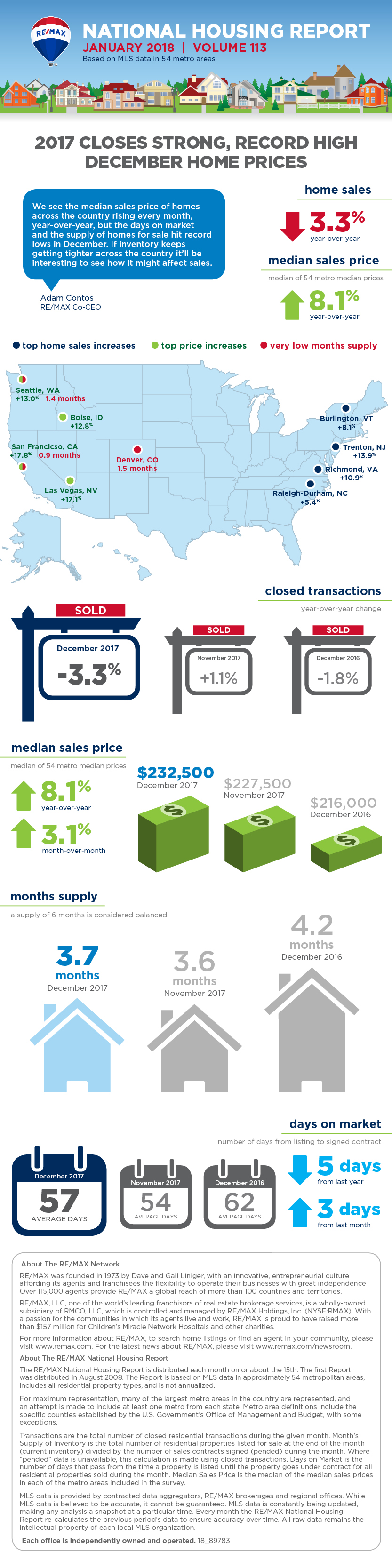

The association said there were 11,477 single-family home sales in 2017, a nearly 7 percent increase over the previous year. The median house price rose almost 4 percent, reaching $196,900.

The association said the number of days homes sat on the market fell from 72 days in 2016 to 54 days in 2017 in the metro area, which encompasses Bernalillo, Valenica, Sandoval, Torrance and parts of Socorro and Santa Fe counties.

Total dollar volume from single-family home sales was $2.7 billion last year, a 12 percent rise from the previous year.

Association President Danny Vigil says last year’s market was difficult for buyers because many homes sold as soon as they were listed, a situation that clearly favored sellers.

“While it’s true that inventory has remained tight all year — a little over a two-month supply at this time — buyers still were not deterred from jumping into the market and were attracted by the area’s variety of price points and property types,” especially new construction, Vigil said.

Homes that were priced right sold fast in popular locations in Albuquerque and Rio Rancho, like the Northeast Heights and the Paradise Hills and Taylor Ranch neighborhoods.

“An area that’s coming on strong is Valencia County,” particularly new housing communities in Las Lunas and Belen, said Vigil, an associate broker with Coldwell Banker Legacy. “Young families get really excited about affordable new construction; they only want to worry about landscaping.”

Condominium sales rose more than 11 percent year over year, while the median sales price of condos sold in 2017 increased almost 1.5 percent to $142,000.

While there are about 3,000 properties currently on offer in the metro area, Vigil expects that number to grow appreciably in the next few months and more “for sale” signs will pop up in yards in the spring. “I have five clients teeing up to sell,” said Vigil. “They’re painting, installing carpeting, clearing out the clutter so they can get top dollar.”

Buyers looking to start the new year with a new home will encounter rising interest rates. Rates have been trending up since mid-September, though they remain just barely under 4 percent.