MAY 2017 RE/MAX NATIONAL MARKET UPDATE

April Home Sales Cooler Than Typical Spring Season

DENVER – The brisk start to the 2017 home-selling season slowed down in April with home sales dropping 4.1% below March and 4.5% below the previous April, according to this month’s RE/MAX National Housing Report.

Yet the narrative of the ever-tightening inventory coupled with increased prices persisted, as the 53 metro area report saw the trends of a seller’s market continuing:

-The average number of Days on Market declined for the third consecutive month and April’s 57 days set a new low for April in the report’s nine-year history.

-The Median Sales Price of $226,000 was the highest price for any April and marked the 13th consecutive month of year-over-year price increases.

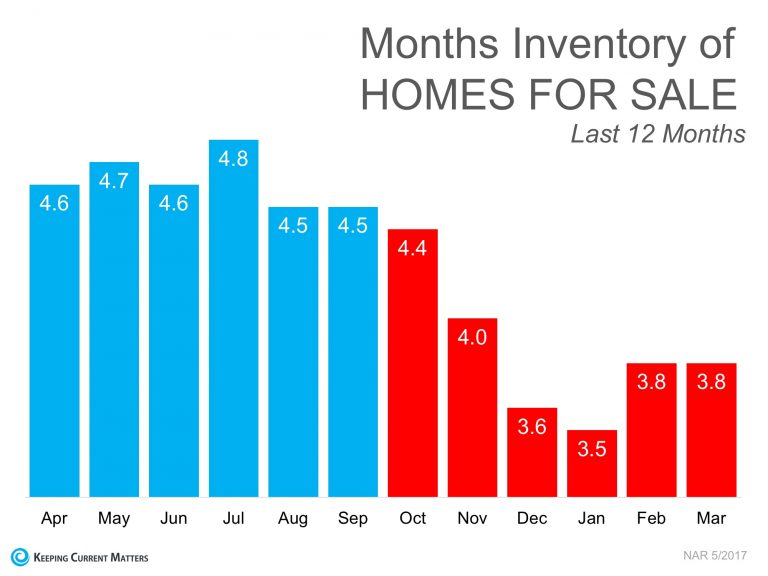

-Months Supply of Inventory, which dropped below 3 months in March for the first time in the report’s history, was 2.8. A months supply of less than 6.0 is considered a seller’s market.

-Inventory was down 17.6% from April 2016. This is the 102nd consecutive month of year-over-year declines dating back to October 2008.

More than three quarters of the report’s 53 metro areas saw April home sales decline year-over-year. By contrast, March posted a 6.6% year-over-year spike in sales. Even so, April saw homes sell for more than they did in March in 81% of the markets, while 92% of the markets saw higher year-over-year sale prices.

“We may be seeing some frustration from buyers,” said Dave Liniger, RE/MAX CEO, Chairman of the Board and Co-Founder. “Inventory is tighter than ever, while strong demand keeps driving up home prices. At the same time, many potential sellers may also be reluctant to list their homes because the tight inventory might impact them as buyers. Home buyers and sellers will need to work with experienced real estate agents to navigate this tough market.”

Closed Transactions

Of the 53 metro areas surveyed in April 2017, the overall average number of home sales decreased 4.5% compared to April 2016. Forty-three of the 53 metro areas experienced a decrease in sales year-over-year or remained unchanged. Ten markets saw an increase in sales, including Wilmington/Dover, DE +13.8%, Fargo, ND +5.7%, Trenton, NJ +5.0%, Phoenix, AZ +4.3% and Houston, TX +2.3%.

Median Sales Price – Median of 53 metro median prices

In April 2017, the median of all 53 metro Median Sales Prices was $226,000, up 0.44% from March 2017 and up 5.2% from April 2016. Only four metro areas saw year-over-year price decreases, with 10 rising by double-digit percentages. The largest double-digit increases were seen in Seattle, WA +13.9%, Dallas/Ft. Worth, TX +12.5%, Charlotte, NC +12.2%, Miami, FL +12.0% and Orlando, FL +11.7%.

Days on Market – Average of 53 metro areas

The average Days on Market for homes sold in April 2017 was 57, down seven days from the average in March 2017, and down seven days from the April 2016 average. The four metro areas with the lowest Days on Market were San Francisco, CA at 22, Denver, CO at 25, Seattle, WA at 26 and Omaha, NE at 27. The highest Days on Market averages were in Augusta, ME at 148 and New York, NY at 96. Days on Market is the number of days between when a home is first listed in an MLS and a sales contract is signed.

Months Supply of Inventory – Average of 53 metro areas

The number of homes for sale in April 2017 was down 1.3% from March 2017, and down 17.6% from April 2016. Based on the rate of home sales in April, the Months Supply of Inventory was 2.8, compared to March 2017 at 2.7 and April 2016 at 3.2. This is the second month in a row months supply has been below 3.0. A 6.0-months supply indicates a market balanced equally between buyers and sellers. In April 2017, 51 of the 53 metro areas surveyed reported a months supply of less than 6.0, which is typically considered a seller’s market. At 6.5, Burlington, VT and at 6.4, Miami, FL were the only two metro areas that saw a months supply above 6.0, which is typically considered a buyer’s market. The markets with the lowest Months Supply of Inventory continued to be in the west, with Seattle, WA remaining at 0.9 for the second month in a row, Denver, CO remaining at 1.0 for the third month in a row and San Francisco, CA at 1.1.